=======================================================

In the fast-evolving world of financial markets, comprehensive backtesting solutions for futures trading have become indispensable tools for traders, hedge funds, and institutions. Backtesting is the process of evaluating a trading strategy using historical market data to simulate how it would have performed in the past. By doing so, traders can refine strategies, manage risk, and increase profitability with greater confidence.

This article explores advanced backtesting methodologies, compares different approaches, and provides a complete roadmap for implementing reliable futures backtesting systems. It also integrates practical insights, current industry trends, and expert recommendations, making it a definitive guide for professional and retail traders alike.

Why Backtesting Matters in Futures Trading

The Role of Backtesting

Backtesting is more than just testing a hypothesis—it’s a risk management and validation framework. A trading idea might look profitable on paper, but without rigorous backtesting, traders risk exposing their capital to unanticipated losses.

Benefits of Comprehensive Backtesting Solutions

- Performance Validation: Helps confirm if a strategy works under different market conditions.

- Risk Assessment: Reveals drawdowns, volatility, and margin requirements.

- Optimization: Enables traders to adjust entry/exit signals, stop-loss placements, and position sizing.

- Scalability: Assists institutional traders in determining whether a strategy can handle larger order flows.

Backtesting essentially bridges the gap between theoretical models and real-world trading.

Types of Comprehensive Backtesting Solutions

1. Historical Data Simulation

This is the most common form of backtesting, where historical futures price data is used to simulate trade executions.

Advantages:

- Straightforward to implement.

- Provides detailed insight into how strategies react to different market phases.

- Large data sets allow for robust statistical validation.

Limitations:

- May suffer from overfitting if too many parameters are optimized.

- Doesn’t account for real-time execution issues like slippage or latency.

2. Monte Carlo Backtesting

Monte Carlo methods generate thousands of simulated trading scenarios by randomizing variables such as order execution, slippage, and market volatility.

Advantages:

- Captures a wider range of market uncertainties.

- Provides probabilistic insights into strategy robustness.

- Useful for stress testing under extreme market conditions.

Limitations:

- Computationally intensive.

- Requires advanced coding or specialized software.

3. Walk-Forward Optimization

Instead of optimizing on the full dataset, walk-forward testing divides data into segments, optimizing on one and testing on the next.

Advantages:

- Reduces the risk of curve fitting.

- Reflects real-world adaptability.

- Popular among institutional futures traders.

Limitations:

- More complex to implement.

- Requires substantial amounts of high-quality data.

4. Hybrid Backtesting Solutions

Combining historical simulation with Monte Carlo stress testing creates a hybrid model that balances accuracy and robustness.

Advantages:

- Captures both historical accuracy and future uncertainties.

- Ideal for futures strategies sensitive to funding rates or leverage.

- Flexible for both retail and institutional use.

Limitations:

- Requires integration of multiple tools.

- Demands a strong technical and quantitative background.

Case Study: Applying Backtesting to Perpetual Futures

A proprietary trading firm tested a momentum strategy on BTC perpetual futures using two approaches: historical simulation and walk-forward optimization.

- Historical Simulation Results: 18% annualized returns, 12% maximum drawdown.

- Walk-Forward Optimization Results: 14% annualized returns, 8% maximum drawdown.

The walk-forward method produced lower returns but offered greater risk-adjusted performance, demonstrating why backtesting is essential in perpetual futures strategy development.

Comparing Different Backtesting Methods

| Backtesting Method | Accuracy | Computational Demand | Overfitting Risk | Best Use Case |

|---|---|---|---|---|

| Historical Simulation | High | Low | High | Retail traders & beginners |

| Monte Carlo Simulation | Very High | High | Medium | Risk managers & quant desks |

| Walk-Forward Optimization | High | Medium | Low | Professional traders |

| Hybrid Approach | Very High | Very High | Low | Institutions & advanced users |

Key Features of Comprehensive Backtesting Solutions

- Granular Trade Data: Tick-level data improves accuracy for short-term futures strategies.

- Transaction Cost Modeling: Incorporates slippage, spreads, and funding costs.

- Customizable Parameters: Allows testing across different leverage and margin settings.

- Scalability: Supports multiple futures contracts and cross-asset strategies.

- Visualization Tools: Offers charts, heatmaps, and risk-return diagrams.

Best Practices for Futures Backtesting

Avoid Overfitting

Over-optimizing parameters can make a strategy look perfect on paper but fail in live trading. Always validate using out-of-sample data.

Use Multiple Market Conditions

Backtest across bull, bear, and sideways markets to ensure robustness.

Automate the Process

Automation reduces human error, speeds up iterations, and enables real-time scenario testing. Many platforms now integrate AI-driven automation to improve how to backtest perpetual futures strategies effectively.

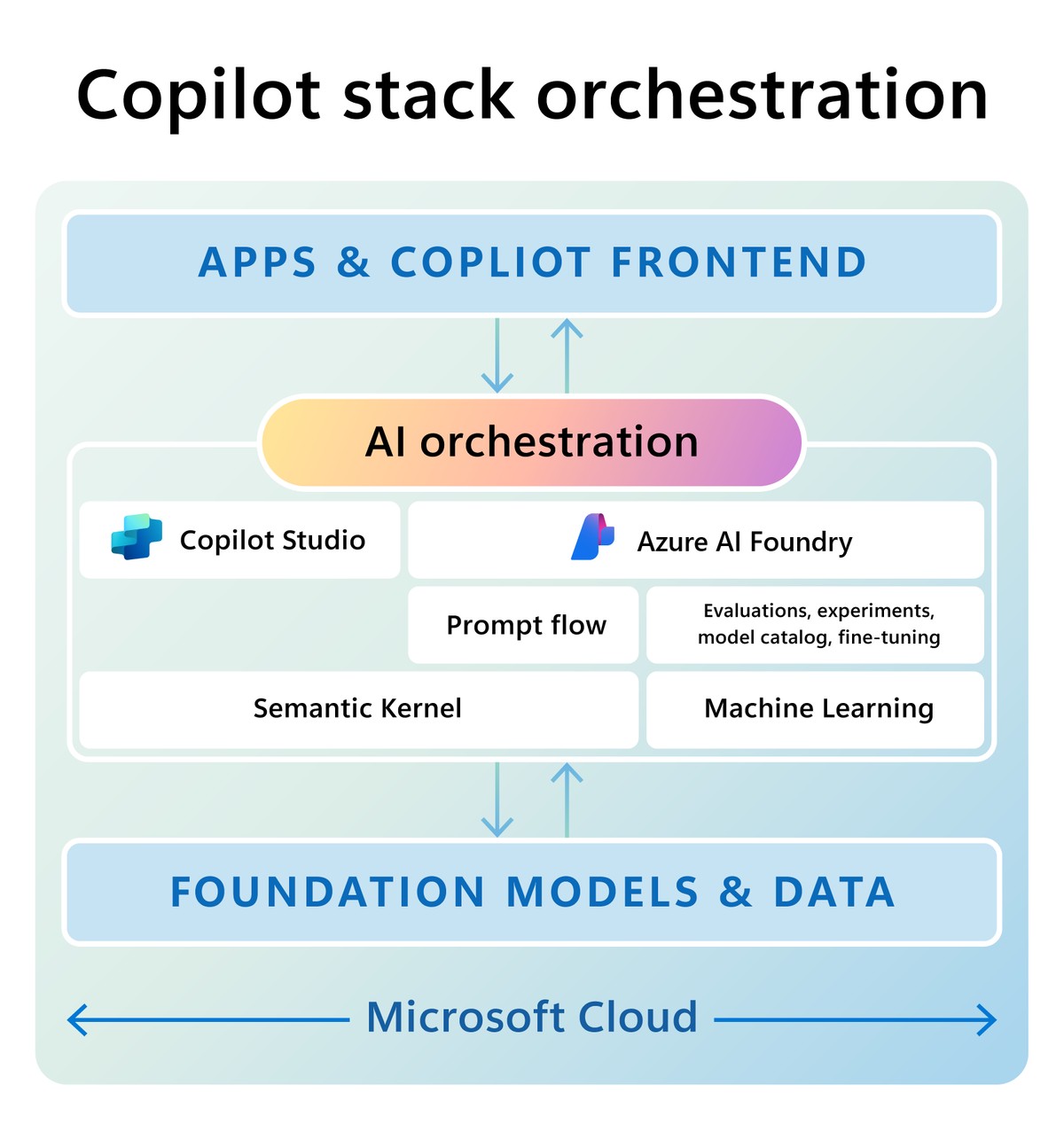

Industry Trends in Backtesting Solutions

- AI and Machine Learning Integration: Predictive models enhance market forecasting accuracy.

- Cloud-Based Platforms: Scalable backtesting environments accessible to both retail and institutional investors.

- Customizable APIs: Allow traders to design proprietary strategies with deep data integration.

- Visualization-First Platforms: Enhanced dashboards simplify complex quantitative analysis.

Visual Insights

Backtesting workflow showing data input, strategy rules, simulation, and results analysis

Comparison of historical simulation vs Monte Carlo testing outcomes

Futures trading risk-return profile derived from walk-forward optimization

FAQ: Comprehensive Backtesting in Futures Trading

1. What’s the most effective backtesting method for futures traders?

It depends on your profile:

- Retail traders benefit most from historical simulations due to simplicity.

- Quant desks and institutions prefer Monte Carlo or hybrid methods for stress testing.

- Professional traders often rely on walk-forward optimization for balance between accuracy and adaptability.

2. How accurate are backtesting results compared to real trading?

Backtesting provides a strong estimate, but discrepancies arise from:

- Execution slippage in real markets.

- Latency differences in algorithmic trading.

- Unexpected liquidity gaps in certain futures contracts.

That’s why robust solutions model these variables during simulation.

3. Where can I find the best backtesting tools for perpetual futures?

Professional platforms such as QuantConnect, MultiCharts, and Trading Technologies offer institutional-grade backtesting tools. Retail traders can explore Backtrader, Amibroker, and MetaTrader. These tools simplify where to find perpetual futures backtesting tools while offering customization and scalability.

Conclusion: Building a Winning Futures Trading Framework

Comprehensive backtesting solutions for futures trading are no longer optional—they are essential. Traders who implement rigorous backtesting gain measurable advantages in risk management, performance validation, and scalability.

The most successful traders combine multiple methods—historical simulation for baseline testing, Monte Carlo for stress scenarios, and walk-forward optimization for adaptability. Hybrid approaches provide the most reliable path to sustainable futures profitability.

As technology advances, backtesting solutions will become even more precise, automated, and accessible. Whether you are a retail investor or managing a hedge fund, investing time and resources into a robust backtesting framework is one of the smartest moves you can make.

💡 Did you find this guide on backtesting solutions insightful?

👉 Share your experiences in the comments, forward this article to your network, and let’s spark a deeper conversation about building profitable and resilient futures trading strategies.

Would you like me to expand this article further with Python backtesting code examples (using libraries like Backtrader or Zipline) so readers can directly implement strategies, making it even more practical?