===================================================================

Trading perpetual futures requires more than just market knowledge—it demands a well-structured execution framework for perpetual futures trading that ensures speed, accuracy, and adaptability. In today’s highly volatile crypto markets, the difference between profit and loss often comes down to execution quality. This article explores practical frameworks, compares strategies, and provides actionable insights for traders at all levels.

What Is an Execution Framework in Perpetual Futures?

Defining the Framework

An execution framework is a structured set of processes, tools, and rules that guide how orders are placed, managed, and closed in perpetual futures markets. It ensures that trades are executed efficiently with minimal slippage, low latency, and optimal cost.

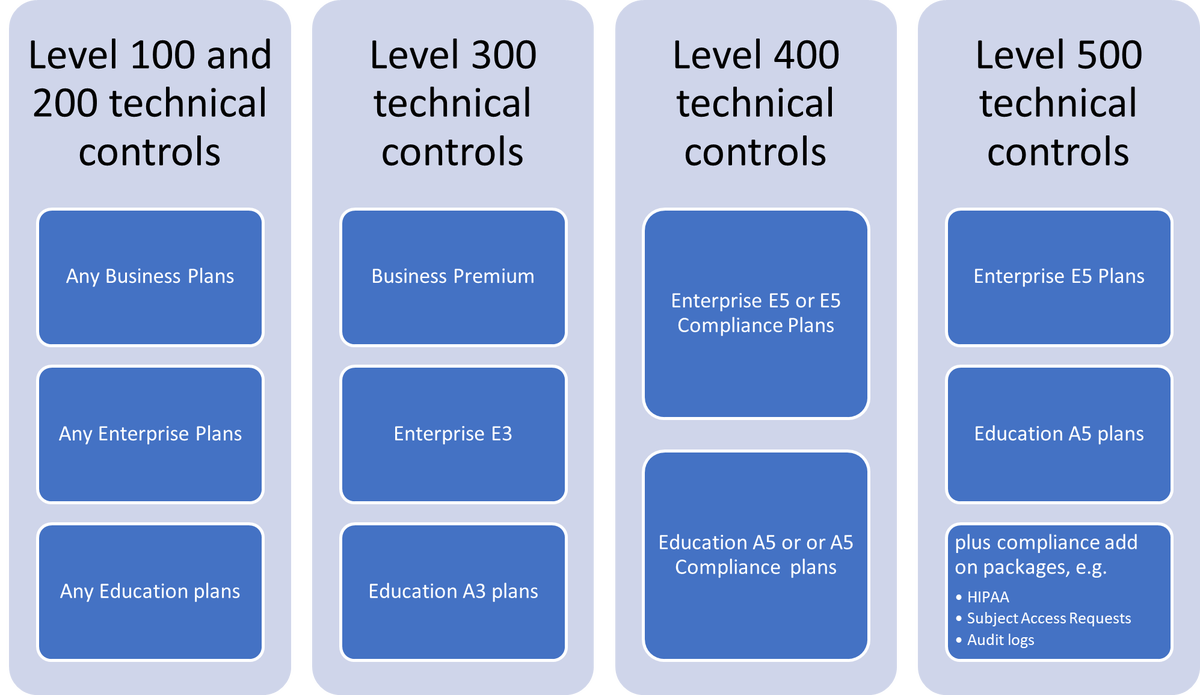

Core Components

- Order Routing: Choosing the best path and exchange to route trades.

- Risk Controls: Automated safeguards to limit unexpected losses.

- Execution Logic: Algorithms and strategies for trade placement.

- Monitoring & Feedback: Real-time analytics for continuous improvement.

Illustration of execution workflow in perpetual futures trading: order routing, risk controls, monitoring

Why Execution Matters in Perpetual Futures

Execution is the backbone of profitable trading. Unlike spot markets, perpetual futures include additional complexities such as funding rates, leverage, and high-frequency activity. Traders must consider:

- Latency Sensitivity: Even milliseconds of delay can mean significant PnL impact.

- Slippage Costs: Poor execution erodes returns, especially for large orders.

- Market Structure: Deep order books and fragmented liquidity increase execution risks.

As a result, many ask: how execution affects perpetual futures trading? The answer lies in precision—bad execution magnifies risk, while strong frameworks enhance consistency and profitability.

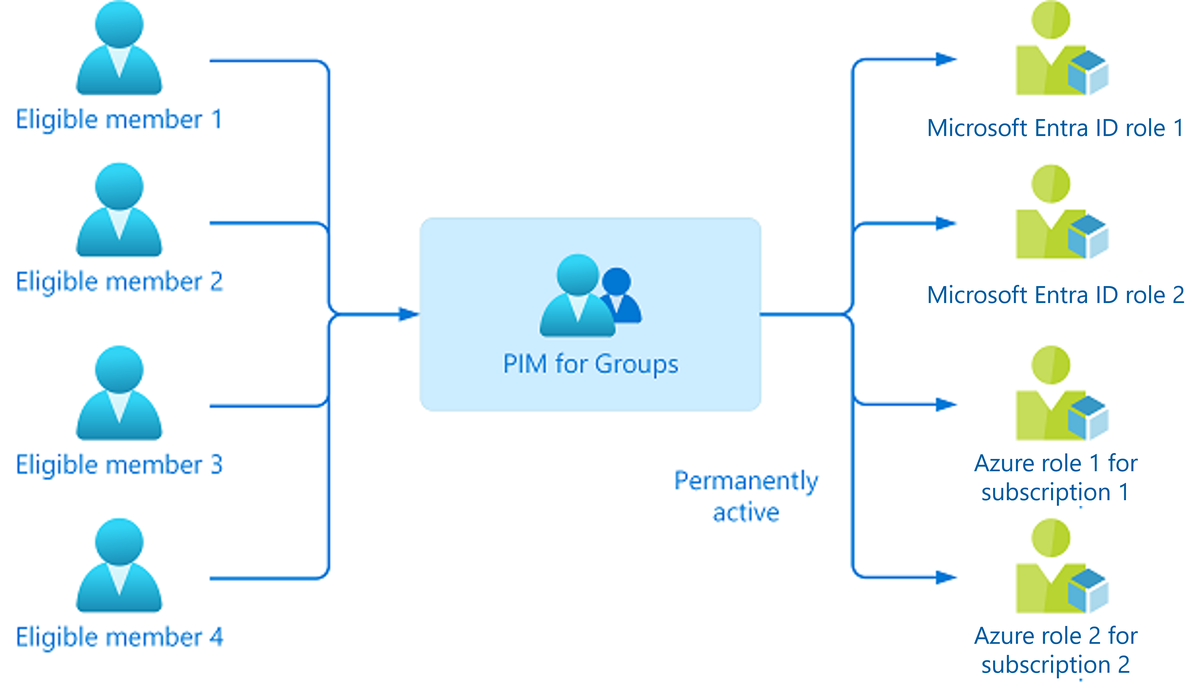

Two Key Execution Frameworks Compared

1. Algorithmic Execution Framework

Algorithmic systems automate order placement and adjustment based on pre-set conditions.

Advantages:

- Handles high-frequency environments.

- Reduces emotional bias.

- Optimizes speed and reduces slippage.

Disadvantages:

- Requires technical expertise to build and maintain.

- Vulnerable to sudden market anomalies (flash crashes, exchange outages).

Best For: Institutional traders, algorithmic desks, and quantitative hedge funds.

2. Manual-Rule Hybrid Execution Framework

This framework blends discretionary decision-making with predefined execution rules.

Advantages:

- Flexible in adapting to unexpected conditions.

- Allows human judgment in volatile or low-liquidity periods.

- Lower technology barrier.

Disadvantages:

- Slower than full automation.

- Human error risk (fat-finger trades, delayed reaction).

Best For: Retail traders, discretionary professionals, and beginners moving toward automation.

Comparison of execution strategies: algorithmic vs manual-rule hybrid approaches

Building an Effective Execution Framework

Step 1: Establish Risk Parameters

Define max loss per trade, daily loss limits, and leverage caps. Automated kill-switches are crucial.

Step 2: Optimize Order Types

- Limit Orders: Reduce slippage, but may miss execution.

- Market Orders: Ensure fill, but increase cost.

- TWAP/VWAP Algorithms: Spread orders over time to minimize impact.

Step 3: Monitor Execution Performance

Execution quality should be measured against benchmarks. Many traders wonder: how to measure execution in perpetual futures? Key metrics include fill rate, slippage, average trade cost, and latency.

Step 4: Integrate Feedback Loops

Performance reports should directly improve future execution logic, creating an adaptive system.

Advanced Execution Enhancements

Latency Optimization

- Deploy servers near exchange data centers.

- Use APIs optimized for speed.

Liquidity Aggregation

Combine liquidity across multiple exchanges to achieve best execution.

Execution Simulation

Backtesting and paper-trading frameworks ensure strategies work before live deployment.

Risk Automation

Stop-losses, trailing stops, and circuit breakers protect against unexpected market swings.

Execution Strategy Recommendation

- Beginners: Start with manual-rule hybrid frameworks; focus on risk control and gradually add automation.

- Experienced Traders: Adopt algorithmic frameworks with execution algorithms (TWAP, iceberg orders, smart order routing).

- Institutions: Implement high-frequency execution with colocation, liquidity aggregation, and risk engines.

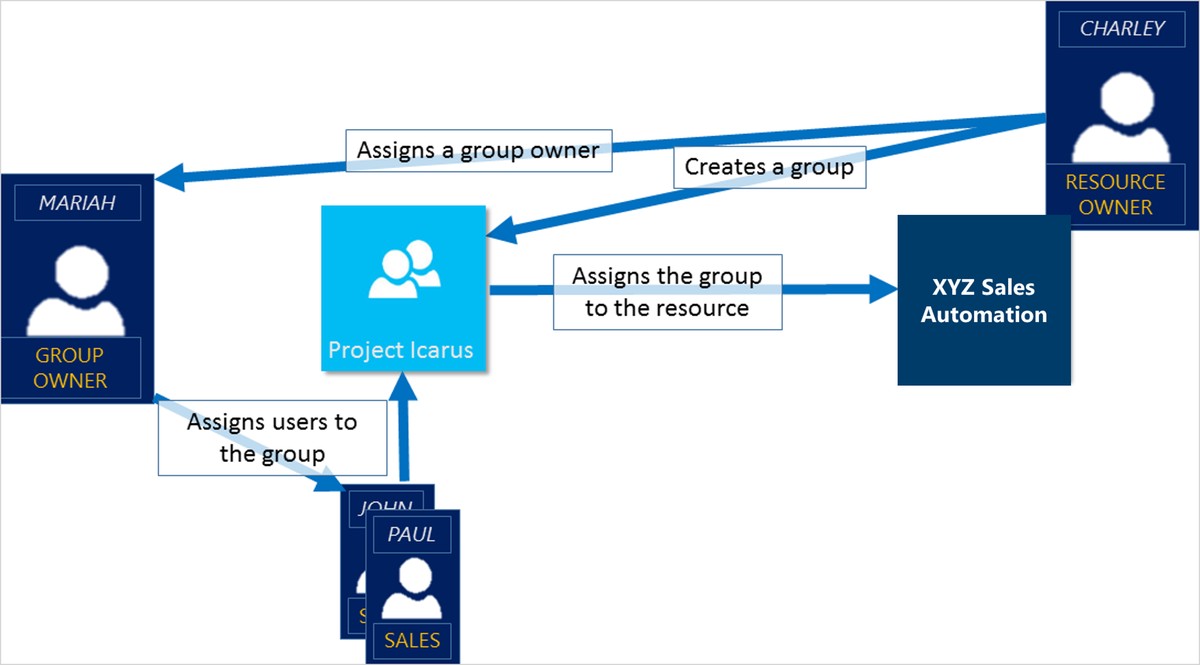

Case Study: Hybrid Execution in Action

A retail trader manages $100,000 in perpetual futures.

- Uses automated scripts for risk management and TWAP execution.

- Retains discretion to override orders during high-volatility events.

- Results: Reduced slippage by 15%, fewer emotional trades, better execution consistency.

This hybrid approach bridges retail accessibility and institutional-grade discipline.

FAQs: Execution Framework for Perpetual Futures Trading

1. What’s the most common execution mistake beginners make?

Beginners often rely too heavily on market orders, leading to excessive slippage. A rule-based hybrid framework with limit orders can significantly improve results.

2. How do I know if my execution framework is working?

Measure slippage and latency against your chosen benchmarks. If execution costs consistently erode more than 0.1–0.2% of trade value, improvements are needed.

3. Do I need algorithmic execution to succeed in perpetual futures?

Not necessarily. Algorithmic frameworks help in high-frequency environments, but disciplined manual-rule frameworks with strong risk management are effective for many retail and semi-professional traders.

Conclusion: Execution as the Edge in Perpetual Futures

A well-designed execution framework for perpetual futures trading provides traders with the competitive edge needed in volatile, high-leverage environments. By comparing algorithmic and hybrid approaches, defining risk controls, and constantly optimizing execution, traders can minimize costs and maximize profitability.

If you found this article useful, share it with fellow traders, leave a comment with your own execution tips, and let’s grow a smarter trading community together.

Would you like me to also create a step-by-step execution checklist (PDF/Excel) that traders can download and apply directly?