===========================================================

Introduction

In the fast-growing world of crypto derivatives, perpetual futures have become one of the most widely traded instruments. They provide traders with the flexibility to speculate on price movements without expiration dates, creating both opportunities and risks. However, one of the lesser-discussed yet critical aspects of success in this market is how to identify high-value incentives in perpetual futures.

Incentives, such as fee rebates, funding rate arbitrage, or exchange-specific reward programs, can significantly boost profitability if identified and leveraged correctly. For hobbyists, professional traders, and institutions alike, recognizing where incentives exist — and determining their real value — can mean the difference between mediocre returns and consistent profitability.

This article provides a detailed roadmap for spotting, evaluating, and optimizing high-value incentives in perpetual futures. It draws from both industry trends and practical experiences, offering at least two distinct strategies with pros and cons.

Why Incentives Matter in Perpetual Futures

Incentives in perpetual futures trading are not just perks; they directly impact profitability. Exchanges and liquidity providers often design incentives to:

- Encourage liquidity provision (e.g., maker fee rebates).

- Stabilize funding imbalances between long and short positions.

- Attract new traders through bonuses and competitions.

- Retain active traders with tiered fee structures.

The central question for any trader becomes: Which incentives provide the highest value relative to risk and effort?

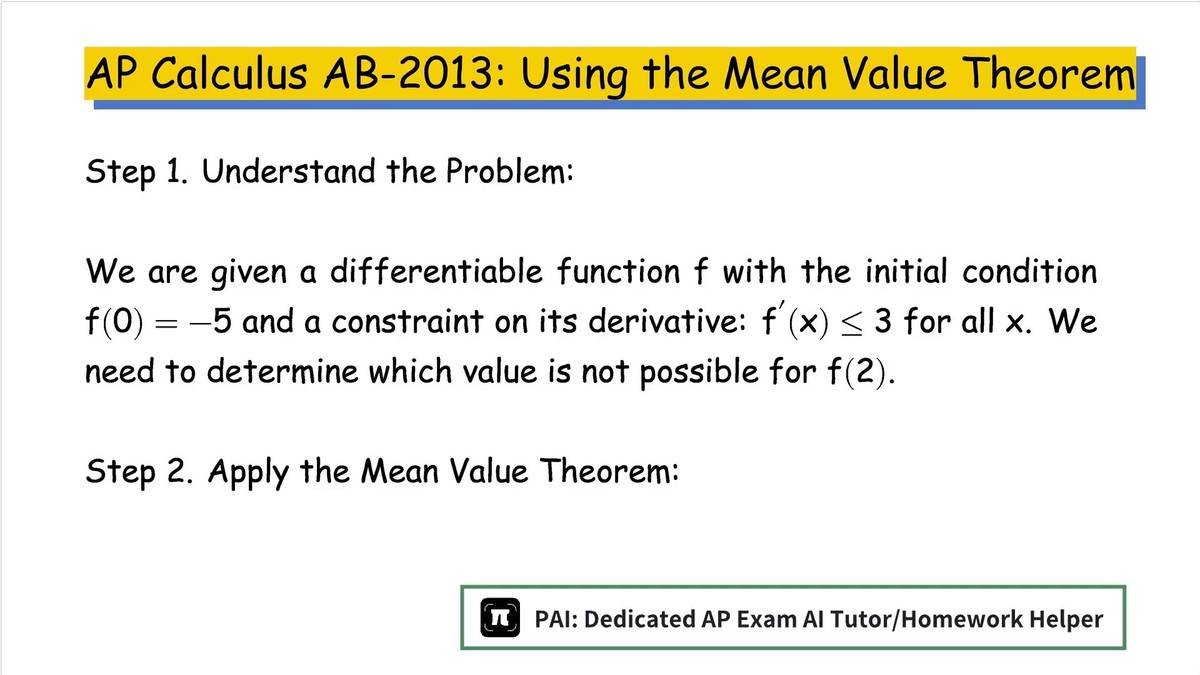

How incentives influence perpetual futures markets

Core Methods to Identify High-Value Incentives

1. Funding Rate Analysis

How It Works

Funding rates are periodic payments exchanged between long and short traders in perpetual futures. They are designed to keep contract prices close to the spot market. By analyzing funding rate patterns, traders can identify opportunities to collect consistent returns.

- Positive funding rate: Shorts receive payments from longs.

- Negative funding rate: Longs receive payments from shorts.

Pros

- Direct and quantifiable incentive.

- Provides steady cash flow in trending markets.

- Can be combined with hedging strategies for risk reduction.

Cons

- Rates fluctuate heavily, reducing predictability.

- Highly competitive; institutional players dominate.

- Requires capital on both spot and futures markets.

2. Exchange-Based Incentive Programs

How It Works

Exchanges frequently introduce reward schemes: fee rebates for market makers, tiered fee discounts for volume traders, or bonus rewards during promotional events. Evaluating these programs and comparing across platforms is crucial.

- Maker rebates: Traders providing liquidity (limit orders) get paid instead of charged.

- VIP tiers: High-volume traders enjoy significantly reduced fees.

- Promotional incentives: Temporary bonuses, such as trading competitions or airdrops.

Pros

- Directly improves net profitability per trade.

- Transparent and easily calculated.

- Often overlooked by casual traders, creating opportunities for those paying attention.

Cons

- Incentives may change suddenly or end without notice.

- High thresholds (e.g., trading volumes) can exclude smaller traders.

- May encourage overtrading, leading to unnecessary risk.

Comparing the Two Strategies

- Funding rate incentives are ideal for traders with balanced portfolios across spot and futures, especially those seeking passive income streams.

- Exchange-based incentives benefit active traders who can meet volume requirements or consistently place liquidity-providing orders.

For many, the best approach is a hybrid model — capturing funding opportunities while simultaneously maximizing rebates and discounts from exchanges.

Comparing different types of incentives in perpetual futures

Advanced Methods for Identifying Incentives

1. Quantitative Modeling of Incentives

Professional traders often build algorithms to track funding rate changes across multiple exchanges in real time. This allows them to enter positions only when incentives surpass a profitability threshold.

This approach connects naturally to How to use incentives in quantitative perpetual futures?, where models can automate decision-making and reduce manual errors.

2. Cross-Exchange Arbitrage with Incentives

Sometimes, one exchange may offer unusually high incentives compared to another. Traders can exploit these imbalances by holding opposing positions across exchanges. However, execution costs and transfer delays must be carefully managed.

Mistakes to Avoid When Evaluating Incentives

- Chasing Incentives Without Risk Control

High incentives often come with high volatility or hidden costs. Don’t sacrifice long-term risk management for short-term gains.

- Ignoring Hidden Costs

Transaction fees, slippage, and withdrawal costs can erode incentive-based profits.

- Over-Leveraging

Incentives may tempt traders to take on excessive leverage, which amplifies risks significantly.

Industry Trends in Perpetual Futures Incentives

- Institutionalization: Large players now build sophisticated models to identify incentives, making markets more efficient.

- Retail Accessibility: Exchanges are increasingly designing incentives tailored to retail futures traders, making it easier for smaller traders to participate.

- DeFi Integration: Decentralized perpetuals introduce governance token rewards, expanding the scope of incentives.

FAQ: How to Identify High-Value Incentives in Perpetual Futures

1. Are funding rate incentives sustainable long term?

Funding rate incentives are cyclical. During strong market trends, they can last for weeks or months. However, they should never be treated as guaranteed income. Successful traders build flexible models that adapt as conditions change.

2. Should I choose an exchange based on incentives alone?

Not necessarily. While incentives are important, factors like liquidity, reliability, and security should take priority. Incentives add value only if the trading environment itself is trustworthy and efficient.

3. How do I know if an incentive program is worth pursuing?

Calculate the net impact: (Incentive received) – (Fees + Slippage + Opportunity costs). If the result consistently improves profitability, it’s worth pursuing. For smaller traders, focus on transparent incentives like maker rebates or VIP tier discounts that scale with activity.

Conclusion

Understanding how to identify high-value incentives in perpetual futures is essential for anyone looking to enhance returns. By analyzing funding rates and comparing exchange programs, traders can uncover hidden profitability streams.

The most effective path is a balanced strategy — combining funding rate opportunities with exchange-specific rebates while always accounting for costs and risks.

If you want to dive deeper into evaluating programs, check out Where to find the best incentives for perpetual futures trading?, which provides detailed insights into comparing exchanges.

👉 Now it’s your turn: Have you identified unique incentive opportunities in your trading? Share your experiences below, and don’t forget to pass this guide along to other traders who may benefit from it!