=============================================================

Swing trading remains one of the most popular strategies among traders who aim to capture medium-term market moves. Unlike day trading, which focuses on intraday volatility, swing trading seeks to exploit trends that play out over several days to weeks. For traders asking how to identify swing trading opportunities, the process involves combining technical analysis, market psychology, and risk management. This article provides a comprehensive guide with actionable strategies, examples, and insights aligned with the latest industry trends.

What is Swing Trading?

Swing trading is a trading style that attempts to capture short- to medium-term gains in a financial instrument over a period of days or weeks. Traders use a mix of technical indicators, chart patterns, and fundamental catalysts to identify profitable opportunities.

Key Characteristics of Swing Trading

- Timeframe: Positions typically last from 2 days to several weeks.

- Goal: Capture a portion of the expected move, not the entire trend.

- Tools: Technical analysis, candlestick patterns, moving averages, support and resistance.

- Markets: Stocks, forex, commodities, and even crypto assets.

Swing trading strikes a balance between day trading’s intensity and long-term investing’s patience, making it attractive for traders with limited time but strong analytical discipline.

Core Methods to Identify Swing Trading Opportunities

1. Using Technical Indicators

Technical indicators are the backbone of swing trading. They provide visual confirmation of trends and potential reversals.

Moving Averages (MA)

- Simple Moving Average (SMA) and Exponential Moving Average (EMA) are most used.

- A common strategy is the moving average crossover: when a shorter-term MA (e.g., 20-day EMA) crosses above a longer-term MA (e.g., 50-day EMA), it signals a bullish opportunity.

- Conversely, a bearish crossover suggests a potential short trade.

Relative Strength Index (RSI)

- Identifies overbought (>70) and oversold (<30) conditions.

- For swing traders, RSI divergences can highlight early trend reversals.

MACD (Moving Average Convergence Divergence)

- Signals momentum shifts.

- Bullish signals occur when the MACD line crosses above the signal line; bearish signals occur when it crosses below.

Pros of Indicators

- Easy to apply with most charting platforms.

- Offer clear entry/exit signals.

- Reduce emotional bias.

Cons of Indicators

- Lagging nature; signals often come after the move has started.

- False signals in highly volatile markets.

2. Identifying Chart Patterns

Chart patterns remain highly reliable for swing trading opportunities.

Breakout Patterns

- Triangles, flags, and pennants often precede sharp price moves.

- Traders enter when price breaks above resistance or below support with strong volume.

Reversal Patterns

- Head and Shoulders (bearish) or Inverse Head and Shoulders (bullish) signal potential major reversals.

- Swing traders can enter after the neckline breaks.

Continuation Patterns

- Cup and Handle suggests a bullish continuation.

- Useful for spotting medium-term entries in trending markets.

Pros of Patterns

- Provide visually intuitive signals.

- Allow traders to plan entries, stops, and targets precisely.

Cons of Patterns

- Subjective; two traders may interpret the same chart differently.

- Breakouts can fail without strong volume confirmation.

Combining Methods for Better Accuracy

The best swing trading opportunities often emerge when technical indicators and chart patterns align. For example:

- A bullish RSI divergence occurs simultaneously with a breakout above a triangle pattern.

- A moving average crossover aligns with a cup-and-handle breakout.

By combining multiple methods, traders improve accuracy and reduce false signals.

Modern Swing Trading Tools and Platforms

Swing traders today benefit from advanced platforms and tools:

- TradingView: For charting, community insights, and indicator overlays.

- MetaTrader 4⁄5: Widely used for forex swing trading.

- AI-powered screeners: Help scan markets for RSI levels, MA crossovers, or pattern formations.

For traders who want structured learning, many look into swing trading strategies for beginners to establish a foundation before scaling into complex methods.

Case Study: Applying Swing Trading in Crypto

Crypto markets, with 24⁄7 availability and strong volatility, are fertile ground for swing trading.

- Example: Bitcoin consolidates in a triangle at $25,000. RSI shows oversold signals while EMA crossover points to bullish momentum.

- Outcome: A breakout above \(26,000 with volume confirms the swing trade, leading to a move toward \)28,000.

This highlights why many traders explore how to perform swing trading in perpetual futures, where leverage and liquidity enhance potential gains.

Risk Management in Swing Trading

No opportunity is complete without robust risk control.

Position Sizing

- Risk only 1–2% of account equity per trade.

Stop-Loss Placement

- Place below recent swing lows in long trades or above swing highs in short trades.

Take-Profit Strategies

- Scale out profits at key resistance or Fibonacci retracement levels.

Real-World Example of Opportunity Identification

A swing trader analyzing Apple (AAPL) identifies:

- RSI bullish divergence at support.

- A breakout from a descending triangle with volume.

- 20-day EMA crossing above 50-day EMA.

The trade is taken with a stop-loss just under the support zone and a target at the next resistance level. Within two weeks, the position yields a 12% profit.

FAQs on Identifying Swing Trading Opportunities

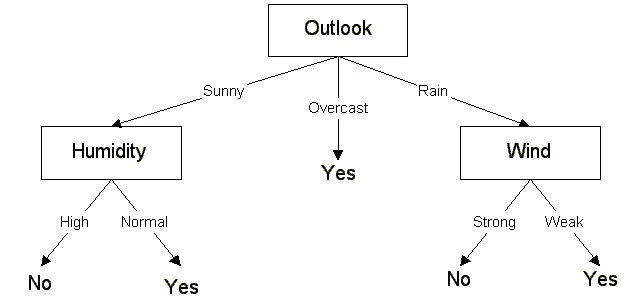

1. How can beginners start identifying swing trading opportunities?

Beginners should start with simple tools like moving averages and RSI. Combine these with support and resistance levels to spot trades. Begin on demo accounts before risking capital, and gradually progress to advanced chart patterns.

2. Which markets are best for swing trading opportunities?

Stocks, forex, and crypto are all excellent. Stocks offer predictable earnings-driven swings, forex provides liquidity, and crypto offers volatility. The best market depends on your risk appetite and time commitment.

3. How do I know if a breakout is real or false?

Look for confirmation via trading volume. A breakout with low volume often fails, while one with strong volume typically sustains momentum. Also, check if the breakout aligns with broader market trends.

Conclusion

Identifying swing trading opportunities requires blending technical indicators, chart patterns, and risk management. By aligning multiple signals and confirming with volume and momentum, traders can improve success rates. Swing trading offers flexibility, especially for those balancing trading with other commitments, and it remains effective across stocks, forex, and crypto.

If you found this guide valuable, share it with fellow traders and drop your insights in the comments. Swing trading thrives on community knowledge, and your input could help others refine their strategies.

Encourage sharing:

👉 Did this article help you understand how to identify swing trading opportunities better? Share it with your trading network and join the discussion below!

Would you like me to create custom infographics (e.g., RSI breakout flowchart, swing trading decision tree) to embed directly in this article so it matches the visual-rich SEO requirement you mentioned?