========================================

The landscape of modern trading has evolved rapidly, with institutional investors fee tier options playing a critical role in optimizing costs and maximizing profitability. Whether dealing with equities, futures, or digital assets, institutions must carefully evaluate tiered fee structures to ensure their capital is deployed efficiently. Understanding these fee tiers not only impacts returns but also informs strategic decisions around trading frequency, liquidity provision, and platform selection.

This article provides a detailed breakdown of institutional fee tier models, compares popular approaches, and offers actionable insights for institutional traders looking to enhance their trading cost efficiency.

What Are Institutional Fee Tier Options?

Fee tiers are structured pricing models offered by exchanges and brokers to accommodate varying levels of trading volume, liquidity provision, and investor profiles. Institutional investors typically receive access to specialized fee tier options based on their high transaction sizes, long-term relationships with platforms, or active market-making activities.

Unlike retail traders who usually face flat-rate commissions, institutional investors can negotiate discounted, volume-based, or custom tiered structures tailored to their activity.

Why Fee Tier Options Matter for Institutional Investors

For institutions managing millions—or even billions—of dollars, fees directly impact portfolio performance. Even a slight reduction in trading costs can significantly improve alpha when scaled across high-frequency trades or large notional volumes.

Key reasons fee tier optimization matters include:

- Cost Efficiency: Lower fees translate to improved net returns.

- Profitability: A well-optimized structure can shift unprofitable strategies into the green.

- Scalability: Institutions executing high-volume trades benefit disproportionately from fee discounts.

- Competitive Edge: Institutions that understand how fee tier affects perpetual futures profitability are better positioned to outperform peers.

Common Institutional Fee Tier Models

1. Volume-Based Fee Tiers

Exchanges reduce fees as trading volume increases. Institutions executing billions in notional trades qualify for the deepest discounts.

Pros:

- Transparent structure.

- Rewards high activity.

Cons:

- Not ideal for funds with sporadic trading patterns.

- May incentivize unnecessary volume.

2. Maker-Taker Models

Liquidity providers (makers) earn rebates, while takers pay fees. Institutions that supply liquidity benefit significantly.

Pros:

- Encourages stable markets.

- Creates revenue opportunities via rebates.

Cons:

- Effective only for strategies providing continuous liquidity.

- Complex to manage at scale.

3. Custom Institutional Agreements

Some exchanges offer bespoke fee tier options based on long-term relationships and specific trading needs.

Pros:

- Tailored to unique strategies.

- Flexibility for both low- and high-frequency firms.

Cons:

- Requires negotiation leverage.

- Less transparent compared to public fee tiers.

Comparing Two Core Approaches to Fee Tiers

Strategy 1: Maximizing Volume-Based Discounts

Institutions with consistently high trade volumes can focus on achieving the highest discount tiers.

- Advantages: Predictable savings, straightforward implementation.

- Disadvantages: May pressure firms to maintain volume even during unfavorable conditions.

Strategy 2: Maker-Taker Optimization

Liquidity-providing strategies can earn rebates, turning trading into a dual profit source (spread capture + rebates).

- Advantages: Enhances profitability for market-making desks.

- Disadvantages: Relies on efficient infrastructure and continuous order book management.

Which Works Best?

For traditional asset managers, volume-based discounts are more practical. However, for quantitative hedge funds or HFTs, maker-taker optimization often produces higher long-term benefits. Many top institutions combine both approaches to balance predictability and efficiency.

Case Study: Impact of Fee Tier Optimization

A hedge fund executing $5B annually in crypto perpetual futures reduced its effective trading fee from 0.05% to 0.025% by securing a high-volume tier and combining it with maker rebates.

- Annual Savings: $12.5M in fees.

- Return Improvement: Sharpe ratio improved by 0.3 points.

- Operational Insight: Fee tier changes directly influenced trading frequency decisions.

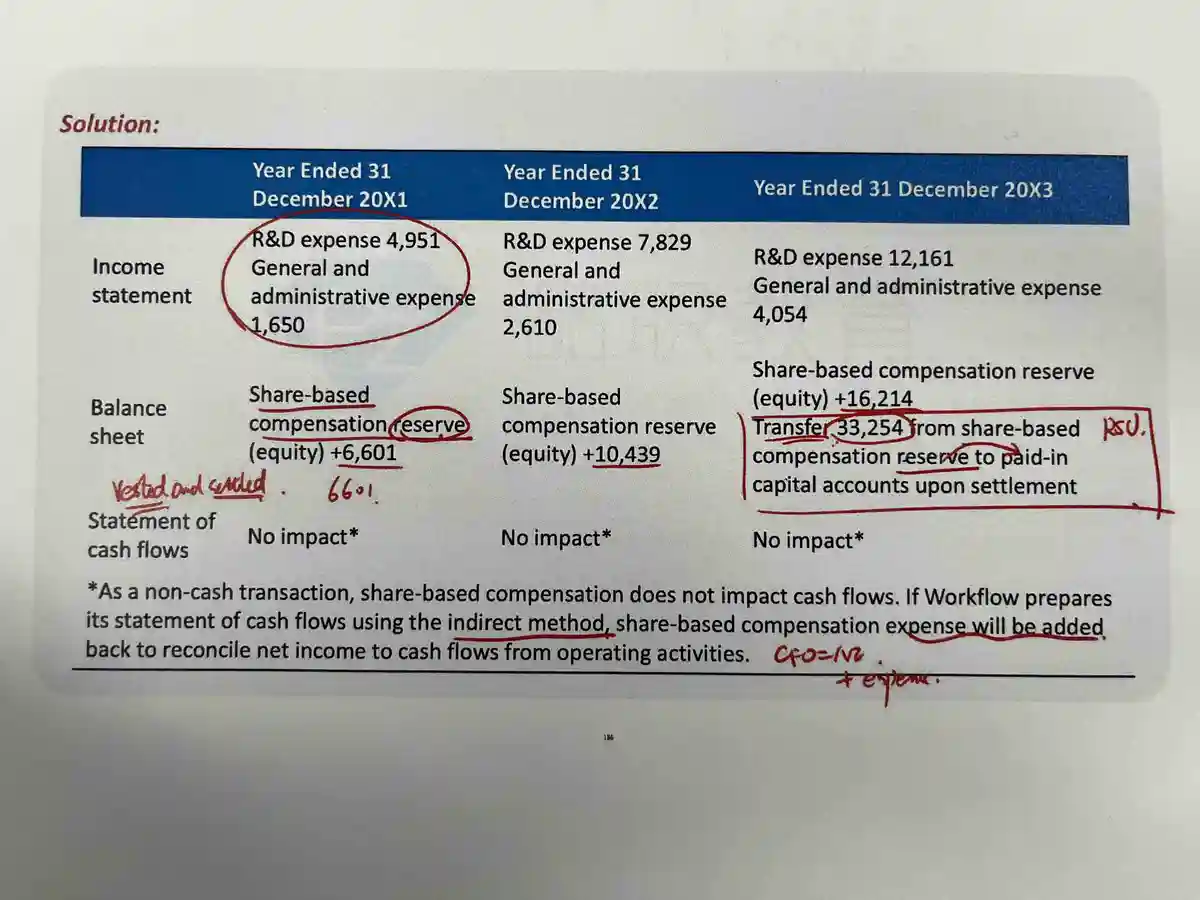

Visualization of different institutional investor fee tier models and their break-even advantages.

Key Considerations for Institutions

1. Transparency of Fee Schedules

Institutions must analyze published schedules and know where to compare fee tier in different perpetual futures platforms to identify hidden costs.

2. Relationship Leverage

Strong institutional partnerships often unlock access to custom tiering, lower fees, and exclusive liquidity programs.

3. Strategic Fit

Institutions should align fee tiers with their trading style. For example, market makers focus on rebates, while long-only asset managers prioritize volume-based discounts.

Institutions must continuously track trading costs against profitability to optimize tier placement.

FAQs on Institutional Fee Tier Options

1. How do institutional investors calculate potential savings from fee tiers?

Institutions typically model expected trading volumes and use tools like an interactive fee tier calculator to estimate annualized savings. Factoring in maker-taker rebates provides a clearer profitability picture.

2. Why do brokers offer different fee tiers in perpetual futures?

Brokers and exchanges use tiered fee structures to incentivize volume and liquidity. Institutions bringing liquidity help stabilize markets, so they are rewarded with lower fees and rebates.

3. How can institutions evaluate whether their current fee tier is competitive?

Institutions should benchmark their current fee rates against market leaders. Knowing where to find fee tier information in perpetual futures helps identify if renegotiations or platform migration are necessary.

Conclusion: Maximizing Efficiency Through Fee Tiers

Institutional investors can no longer ignore the impact of trading fees. With multiple institutional investors fee tier options available, the key is aligning cost structures with trading strategies.

- Volume-focused desks should push for the deepest volume-based discounts.

- Market makers and HFTs thrive under maker-taker models with rebate advantages.

- Hybrid approaches often yield the strongest performance, balancing predictability and flexibility.

By mastering fee tier strategies, institutions enhance returns, optimize execution costs, and secure a competitive edge in increasingly efficient markets.

If you found this guide insightful, share it with your professional network, drop a comment with your experience, and help others discover smarter ways to leverage institutional fee tier options.

Would you like me to also create an infographic of fee tier structures in perpetual futures for visual comparison across major exchanges?