=============================================================

Perpetual futures have become one of the most liquid and dynamic financial instruments in the crypto trading ecosystem. Their continuous nature, combined with funding rate mechanisms, creates unique opportunities for traders who rely on quantitative strategies. However, building a strategy is only half the battle—the real edge lies in knowing how to optimize a quantitative strategy for perpetual futures.

In this comprehensive guide, we will explore optimization techniques, industry trends, and practical insights based on both professional experience and academic research. We will compare multiple approaches, highlight their pros and cons, and provide actionable recommendations for traders at different levels.

Understanding Perpetual Futures in Quantitative Trading

Perpetual futures differ from traditional futures contracts because they never expire. Instead, they rely on a funding rate mechanism to tether their price to the underlying spot asset. This feature makes them ideal for leverage trading but also introduces unique risks and inefficiencies.

A quantitative strategy in perpetual futures uses systematic, data-driven models—such as statistical arbitrage, momentum detection, or machine learning—to exploit these inefficiencies. To truly succeed, optimization ensures that these models adapt to market volatility, liquidity shifts, and evolving trader behavior.

Why Optimization Matters in Perpetual Futures

Without optimization, even the most sophisticated strategies can underperform due to:

- Changing volatility regimes (e.g., crypto bull vs. bear markets).

- Funding rate distortions during high-leverage trading periods.

- Order book depth variability, which directly affects execution quality.

- Latency arbitrage challenges, particularly for high-frequency strategies.

Optimization allows traders to align their models with real-world market conditions and reduce risk while improving returns.

Two Core Methods of Optimization

1. Parameter Tuning and Backtesting

Parameter tuning involves adjusting variables such as:

- Lookback periods for moving averages.

- Thresholds for entering or exiting trades.

- Stop-loss and take-profit ratios.

Traders use backtesting against historical perpetual futures data to evaluate performance. This process highlights overfitting risks while helping refine strategy parameters.

Pros:

- Data-driven and systematic.

- Easy to apply for beginners.

- Allows quick iteration of multiple models.

Cons:

- Historical data may not reflect future volatility regimes.

- Risk of overfitting to noise rather than meaningful patterns.

This approach is closely related to How to backtest a quantitative strategy for perpetual futures, which ensures a robust evaluation before real deployment.

2. Machine Learning and Adaptive Models

Instead of fixed parameters, machine learning models adapt dynamically by learning from ongoing market data. Examples include reinforcement learning strategies that adjust based on funding rate changes or volatility clustering.

Pros:

- Can capture nonlinear patterns missed by static models.

- High adaptability in volatile environments.

- Suitable for professional and institutional traders.

Cons:

- Requires advanced knowledge and computing resources.

- Higher data and infrastructure costs.

- Potential for model drift if not frequently retrained.

For many traders, combining parameter tuning with adaptive models provides the most balanced solution.

Industry Trends in Optimization

- High-Frequency Data Analysis – More firms are analyzing tick-level order book data to optimize execution.

- Risk-Based Optimization – Incorporating downside risk metrics like the Sortino ratio rather than focusing solely on raw returns.

- Cross-Asset Learning – Using optimization frameworks from equities and FX trading to improve perpetual futures strategies.

- Cloud-Based Backtesting – Leveraging scalable infrastructure to test hundreds of models in parallel.

Step-by-Step Process to Optimize a Quantitative Strategy

Step 1: Define Clear Objectives

Are you optimizing for maximum returns, risk-adjusted performance, or lower drawdowns? Each requires different approaches.

Step 2: Collect High-Quality Data

Include both spot and perpetual futures data, as funding rates and basis spreads are critical inputs.

Step 3: Test Multiple Models

Run both simple models (e.g., moving averages) and complex ones (e.g., machine learning) for comparative insights.

Step 4: Conduct Walk-Forward Analysis

Split your dataset into multiple periods to avoid overfitting and ensure robustness.

Step 5: Evaluate Risk Metrics

Go beyond Sharpe ratio—include Sortino ratio, max drawdown, and conditional value at risk (CVaR).

Step 6: Implement in Live Trading with Small Capital

Always start with a limited allocation before scaling up.

Comparing Two Optimization Strategies: Risk-Adjusted vs. Execution-Focused

Risk-Adjusted Optimization

This method optimizes for volatility, drawdowns, and downside protection.

Best for: Long-term investors and institutions.

Weakness: May miss short-term arbitrage opportunities.

Execution-Focused Optimization

This focuses on order book depth, latency, and slippage minimization.

Best for: High-frequency and intraday traders.

Weakness: Higher infrastructure costs and technical complexity.

Recommendation: A hybrid approach works best—optimize risk metrics at the portfolio level while optimizing execution at the trade level.

Tools for Optimizing Quantitative Strategies

- Python & R Libraries: Pandas, NumPy, scikit-learn for parameter tuning.

- Backtesting Platforms: QuantConnect, Backtrader, custom in-house engines.

- Execution APIs: Binance Futures API, Bybit API for real-time integration.

- Visualization Tools: Tableau, Plotly for strategy performance dashboards.

This aligns with Where to learn quantitative strategies for perpetual futures, as these tools form the foundation of practical education.

Case Study: Optimizing a Momentum Strategy

A beginner trader implemented a momentum-based strategy on BTC perpetual futures:

- Initial Parameters: 20-period EMA crossover, fixed stop-loss.

- Optimization: Applied walk-forward testing, adjusted risk per trade, and integrated funding rate filters.

- Result: Sharpe ratio improved from 1.1 to 1.6, while max drawdown decreased by 25%.

This illustrates how small adjustments and risk-focused optimization can significantly enhance performance.

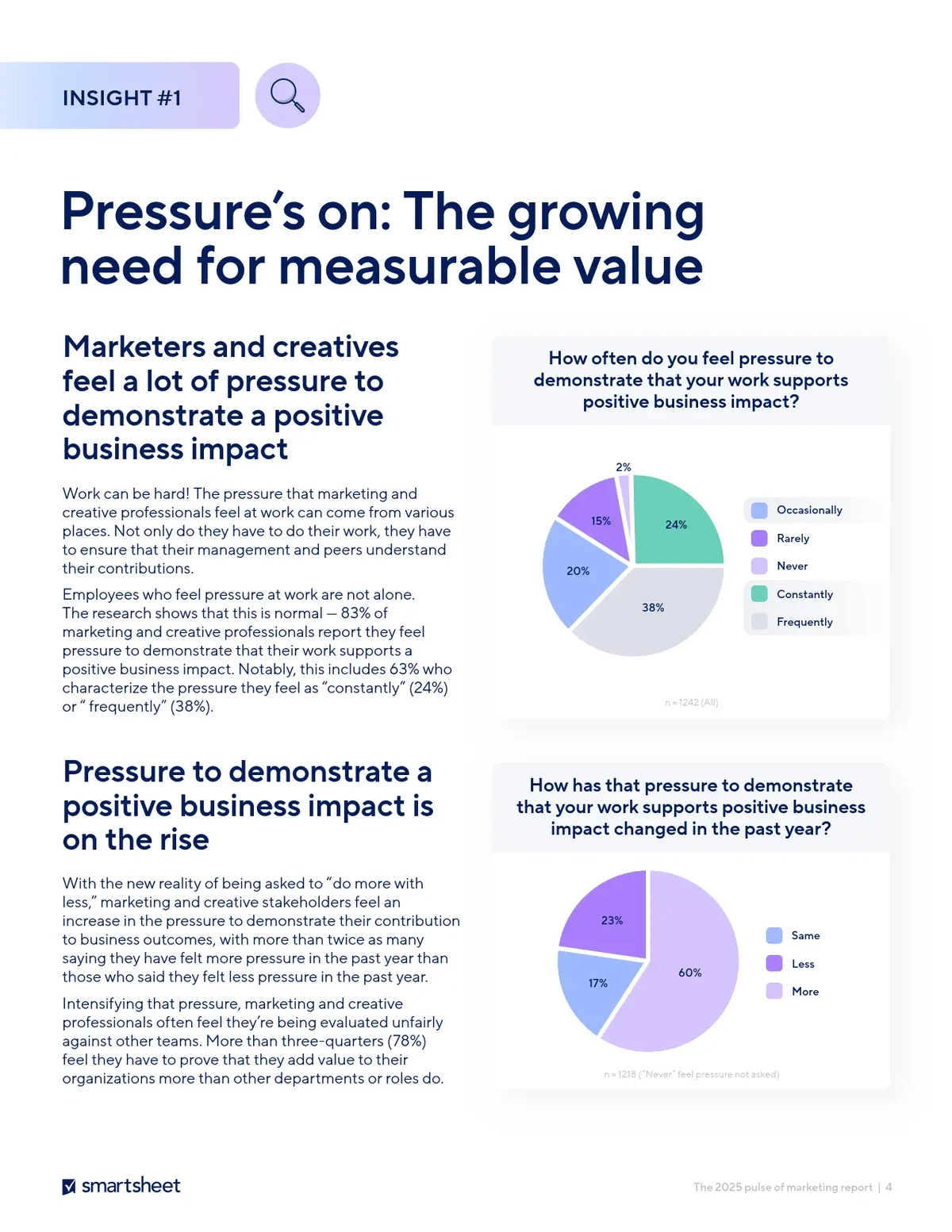

Visual Insights

Workflow for Optimizing a Quantitative Strategy in Perpetual Futures

From data collection to live deployment, optimization requires structured and iterative refinement.

FAQ: How to Optimize a Quantitative Strategy for Perpetual Futures

1. How do I avoid overfitting when optimizing my strategy?

Use walk-forward analysis and out-of-sample testing. Avoid optimizing solely on historical performance; instead, focus on robustness across multiple market conditions.

2. Should I optimize for funding rates in perpetual futures?

Yes. Funding rates can significantly impact profitability, especially in sideways markets. Incorporating funding rate signals into optimization helps balance long and short exposure.

3. What is the best optimization method for beginners?

Start with parameter tuning and simple risk management rules. Machine learning methods are powerful but better suited once you gain experience and access to high-quality infrastructure.

Conclusion: The Path to Effective Optimization

Optimizing a quantitative strategy for perpetual futures is not about finding the “perfect” model but about building resilient, adaptive, and risk-aware systems. By balancing parameter tuning with adaptive learning, traders can improve their edge and remain competitive in dynamic crypto markets.

As perpetual futures trading continues to grow, optimization will increasingly rely on real-time data, advanced machine learning, and robust risk frameworks. Beginners should start small, optimize carefully, and scale gradually—paving the way to long-term success.

If this guide helped you understand how to optimize a quantitative strategy for perpetual futures, share it with your network, leave a comment with your experiences, and spark a conversation with other traders on how they optimize their strategies.

Would you like me to also create a downloadable optimization checklist (PDF format) so you can apply each step methodically in your perpetual futures trading?