=============================================================================

In the world of high-speed financial markets, professional traders’ latency challenges have become one of the most pressing issues for maintaining profitability and competitiveness. Latency, defined as the time delay between order placement and execution, can mean the difference between capturing an opportunity and missing it entirely. For institutional traders, hedge funds, and high-frequency trading (HFT) firms, even a few microseconds of delay can translate into significant financial losses.

This article provides a comprehensive exploration of latency challenges faced by professional traders, offering strategies, solutions, and expert insights. We’ll examine two core latency management strategies, compare their pros and cons, highlight the latest industry trends, and address common questions from trading professionals.

Understanding Latency in Professional Trading

Latency is not just about speed—it’s about precision, reliability, and consistency. Traders often describe latency as the “hidden cost” of trading, since it directly impacts trade execution and slippage.

Key Components of Latency

- Market Data Latency

The delay in receiving real-time market data from exchanges. Faster data feeds give traders an edge.

- Order Routing Latency

The time it takes for an order to travel from the trader’s system to the exchange’s matching engine.

- Exchange Processing Latency

The time exchanges take to validate, match, and confirm orders.

- Confirmation Latency

The delay in receiving order execution confirmation back from the exchange.

Why Latency Matters for Professionals

For institutional and algorithmic traders, latency is tied to profitability. Delayed execution leads to:

- Missed arbitrage opportunities

- Increased slippage

- Reduced effectiveness of quantitative strategies

- Competitive disadvantage against firms with lower latency

Strategy 1: Infrastructure Optimization for Lower Latency

Professional traders often invest heavily in hardware and network optimization to reduce latency. This includes everything from colocating servers in data centers to deploying specialized trading hardware.

Key Methods

- Colocation Services: Renting rack space in exchange data centers ensures minimal distance to matching engines.

- Direct Market Access (DMA): Bypasses intermediaries, allowing orders to go directly to exchanges.

- Custom Hardware: Use of Field Programmable Gate Arrays (FPGAs) and low-latency switches for real-time processing.

- Optimized Network Routing: Leveraging microwave, fiber-optic, or even satellite connections to reduce round-trip latency.

Pros:

- Ultra-fast order execution.

- Competitive edge in high-frequency and arbitrage trading.

- Reliable performance with minimal slippage.

Cons:

- Extremely expensive, often costing millions annually.

- Not accessible to smaller firms or retail traders.

- Requires ongoing maintenance and upgrades.

Strategy 2: Algorithmic Adaptation to Latency

Not all traders can afford infrastructure-level optimizations. Many professional traders address latency by designing algorithms that adapt to latency conditions instead of attempting to eliminate latency completely.

Key Methods

- Latency-Tolerant Strategies: Algorithms designed to thrive in environments with slightly higher latency, such as statistical arbitrage or swing trading.

- Smart Order Routing (SOR): Algorithms that dynamically choose the best exchange based on current latency and liquidity conditions.

- Batch Order Execution: Sending bundled orders at specific intervals to offset the effect of latency spikes.

- Adaptive Market-Making: Adjusting bid/ask spreads to account for expected latency slippage.

Pros:

- Cost-effective compared to hardware solutions.

- More accessible to mid-sized firms and quant traders.

- Can be tailored to specific markets, such as cryptocurrency or forex.

Cons:

- Slower than hardware-based optimizations.

- Algorithms may require frequent tuning as market conditions evolve.

- Performance is still partially constrained by latency limits.

Comparing the Two Strategies

| Aspect | Infrastructure Optimization | Algorithmic Adaptation |

|---|---|---|

| Speed | Ultra-low latency (microseconds) | Moderate latency (milliseconds) |

| Cost | Very high (millions/year) | Moderate (software and R&D costs) |

| Flexibility | Fixed, hardware-dependent | Highly flexible, adaptable |

| Accessibility | Limited to institutional traders | Open to professionals and quants |

| Best Use Case | High-frequency trading, arbitrage | Swing trading, market-making, crypto |

Industry Trends: Addressing Latency Challenges in 2025

The landscape of latency management is constantly evolving. Some notable trends include:

- Hybrid Solutions: Firms are combining colocation with latency-adaptive algorithms to balance speed and flexibility.

- AI and Machine Learning: Predictive models help forecast latency spikes and optimize execution in real-time.

- Cloud-Based Low-Latency Services: Providers are offering “latency-as-a-service” models for firms unable to build in-house infrastructure.

- Cryptocurrency Latency Challenges: As crypto markets mature, professional traders are now focused on how does latency affect perpetual futures trading, particularly as decentralized exchanges (DEXs) introduce new forms of latency.

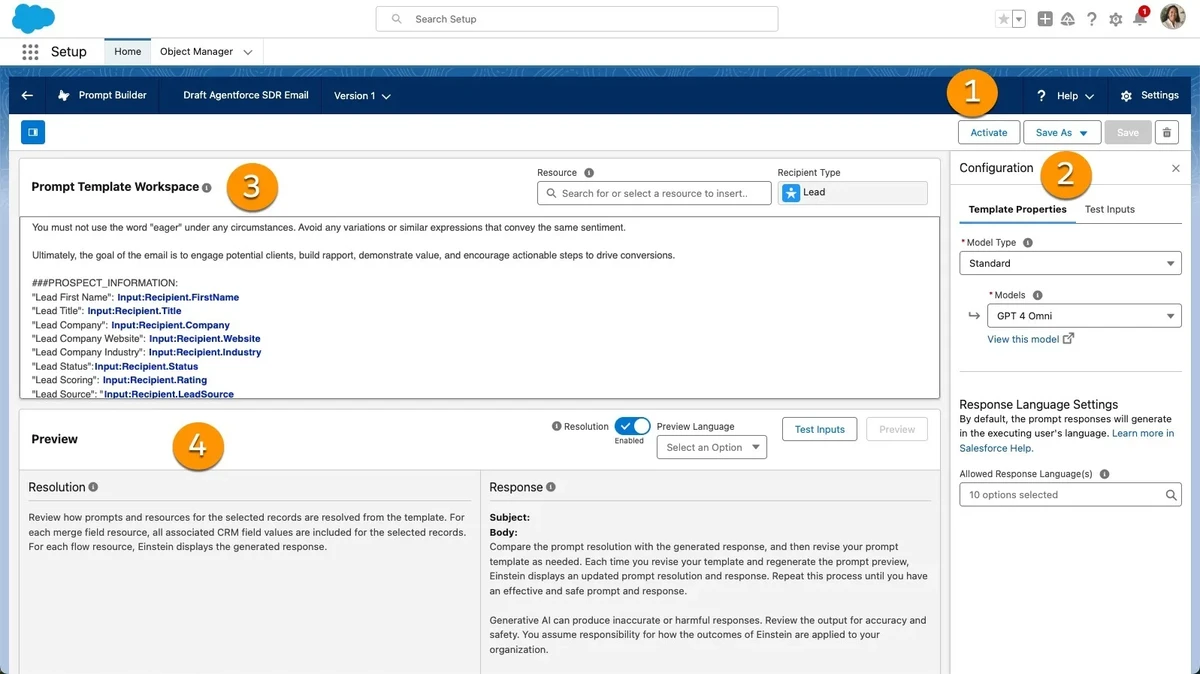

Latency layers in professional trading

Expert Insights: Best Practices to Overcome Latency

- Measure First, Optimize Later

You can’t improve what you can’t measure. Start with accurate benchmarks. Many firms explore where to check latency issues in quant trading before investing in infrastructure or algorithmic redesign.

- Balance Cost and Benefit

Infrastructure optimization provides the fastest execution but comes at high cost. Mid-tier firms often find more ROI in algorithmic adaptation.

- Continuous Monitoring

Latency is dynamic. Network congestion, exchange updates, and global events can all impact latency unpredictably. Use real-time monitoring tools for constant oversight.

FAQ: Professional Traders’ Latency Challenges

1. Why do professional traders care so much about latency?

Because even a fraction of a second can impact profitability. In HFT and arbitrage, profits are razor-thin and depend on speed. For professionals, latency is equivalent to execution risk—higher latency often means missed trades or increased slippage.

2. Can retail traders benefit from low-latency setups?

Retail traders can benefit, but typically they don’t need ultra-low latency. While institutional traders invest in microsecond improvements, retail traders often focus on execution quality and strategy design rather than speed. That said, retail traders can still reduce latency by choosing brokers with direct market access and optimized platforms.

3. What is the most effective way to reduce latency in 2025?

The most effective method is a hybrid approach—colocating servers for critical trades while using latency-adaptive algorithms for broader strategy. This ensures cost efficiency and reliability. AI-driven monitoring and real-time routing further enhance performance.

Conclusion: Navigating Latency Challenges with Precision

Professional traders face immense latency challenges in today’s markets, where every microsecond counts. Whether through infrastructure optimization or algorithmic adaptation, the key lies in aligning latency strategies with trading goals, costs, and resources.

- For HFT and arbitrage, hardware-driven latency reduction remains essential.

- For swing trading, crypto, and mid-frequency strategies, latency-adaptive algorithms are often more practical.

- The best results often come from combining both approaches into a holistic latency management strategy.

Latency is no longer just a technological issue—it’s a competitive differentiator. The firms that master it will dominate trading in 2025 and beyond.

💬 What’s your biggest challenge with latency in trading? Share your experiences below, and don’t forget to share this article with colleagues and fellow traders who face similar latency concerns.

Would you like me to create a dedicated infographic of latency-reduction strategies so you can use it as a visual reference in presentations or team discussions?