==========================================================

Introduction

For professional traders, fees can significantly affect long-term profitability. Even small differences in trading costs compound quickly, especially for high-frequency or high-volume strategies. This is why professional traders fee tier comparison is one of the most essential exercises for anyone serious about maximizing returns in perpetual futures or spot markets.

In this article, we’ll dive into the details of how fee tiers work, compare structures across different exchanges, and evaluate strategies professionals use to minimize costs. We’ll also cover real-world experiences, advanced tools, and recent industry trends to help traders make informed decisions.

What Are Fee Tiers in Professional Trading?

Fee tiers are pricing structures offered by exchanges or brokers that determine how much a trader pays in commissions per trade. They are usually based on monthly trading volume, liquidity contribution (maker vs taker), or account status (retail vs institutional).

Key Elements of Fee Tiers

- Maker Fees: Paid when adding liquidity to the order book. Often lower or even negative (rebates).

- Taker Fees: Paid when removing liquidity from the order book. Typically higher than maker fees.

- Volume-Based Discounts: Traders get better rates as they hit higher trading volume thresholds.

- VIP or Institutional Plans: Custom pricing for hedge funds, proprietary firms, or market makers.

Understanding why fee tier matters in perpetual futures trading is essential: lower fees directly improve profitability, especially in markets where spreads are tight and competition is fierce.

Industry Trends in Fee Tier Systems

Professional traders today face a highly competitive landscape. Exchanges compete aggressively by offering tiered pricing, rebates, and VIP perks. Some trends include:

- Zero-Fee Promotions: Temporary removal of taker or maker fees to attract new liquidity.

- Dynamic Fee Adjustments: Fees adjusted based on market volatility or trading pairs.

- Custom Fee Tier Plans: Tailored options for institutions or algorithmic traders.

- Integration with Loyalty Programs: Token-based discounts (common in crypto exchanges).

Methods for Comparing Professional Trader Fee Tiers

1. Exchange-to-Exchange Comparison

The most direct method is comparing published fee schedules across multiple platforms. For instance:

- Exchange A: 0.02% maker / 0.05% taker base fee, with 25% discount above $50M volume.

- Exchange B: 0.015% maker / 0.04% taker, plus token-based fee reduction.

Advantages:

- Transparent and simple to evaluate.

- Ideal for traders who already know their average volume.

Disadvantages:

- Published fees don’t always include hidden costs (withdrawal fees, API limits).

- May overlook benefits like rebates or exclusive data access.

2. Effective Cost Per Trade Analysis

Instead of just comparing listed fees, professionals calculate the effective cost per trade after discounts, rebates, and token programs.

Example:

- A taker fee of 0.05% may drop to 0.035% after a token staking discount.

- Maker orders may earn rebates, reducing net trading costs to negative fees.

Advantages:

- Reflects real-world costs.

- Helps traders align fee tiers with strategy type (scalping, arbitrage, swing).

Disadvantages:

- Requires detailed trade data.

- Token values may fluctuate, changing effective costs.

3. Custom Institutional Plans

Large professional traders often negotiate custom rates directly with exchanges.

Advantages:

- Tailored to specific trading needs.

- May include perks like higher API limits, better data feeds, and rebates.

Disadvantages:

- Only accessible for very high-volume traders.

- Requires relationship building with exchange representatives.

Practical Fee Optimization Strategies

Strategy 1: Volume Consolidation

Traders consolidate trading on fewer platforms to maximize volume-based discounts.

Pros: Unlocks deeper tier discounts faster.

Cons: Limits diversification across platforms.

Strategy 2: Maker-Dominant Trading

Algorithms are designed to post liquidity (maker orders) to benefit from rebates.

Pros: Often results in negative net fees.

Cons: Higher risk of missed fills during volatile markets.

Strategy 3: Token Staking Programs

Many crypto exchanges offer fee discounts for staking native tokens.

Pros: Substantial savings on taker fees.

Cons: Exposes traders to token price volatility.

Case Study: Professional Fee Tier Impact

A professional day trader executes 10,000 trades per month with an average position size of $50,000.

- At 0.05% taker fee, monthly cost = $250,000.

- At a reduced 0.03% VIP tier, monthly cost = $150,000.

This $100,000 monthly savings demonstrates why professional traders obsess over fee tier optimization.

For deeper insights, traders often use where to find fee tier information in perpetual futures to evaluate opportunities before committing to a platform.

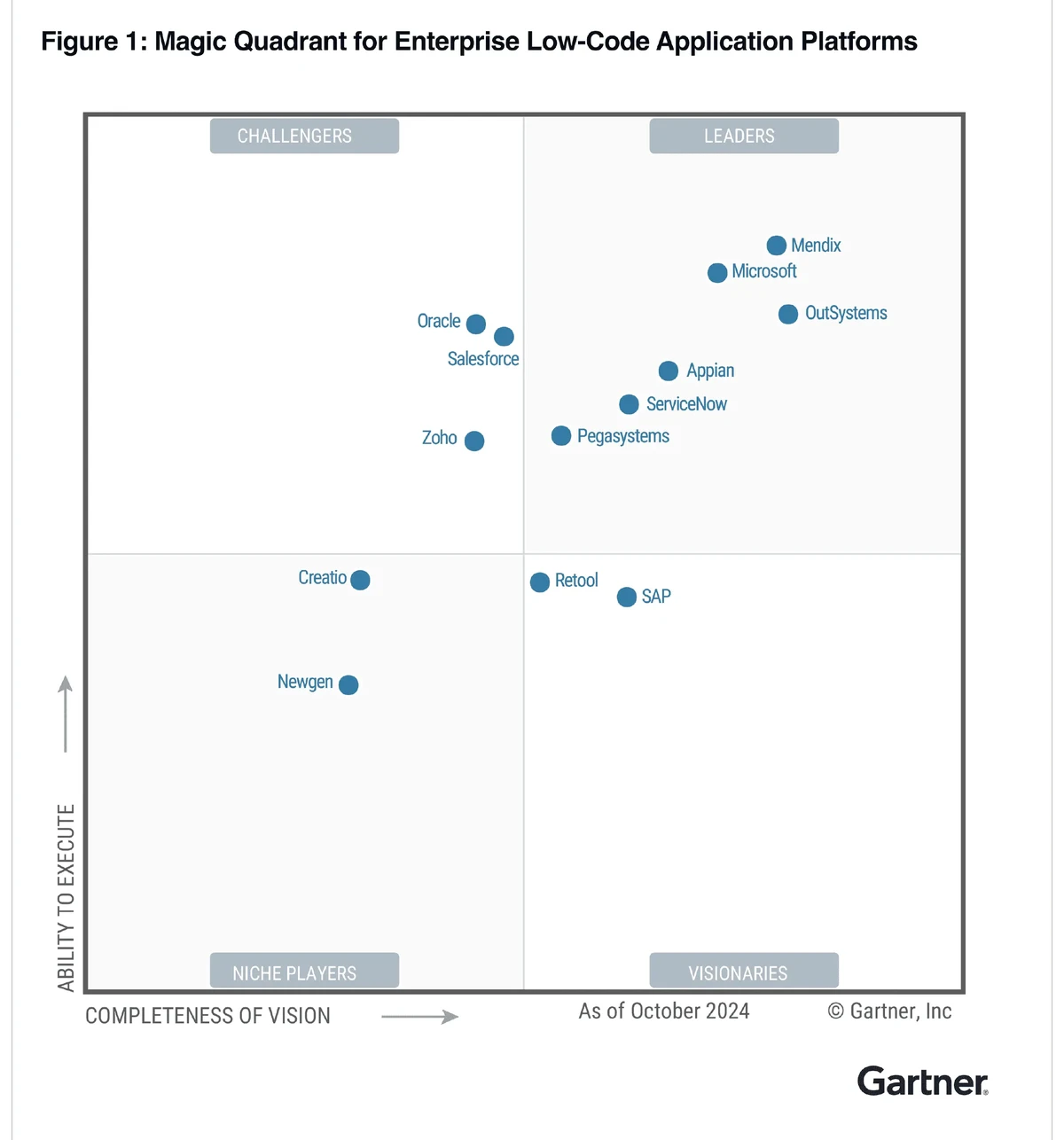

Visual Comparison

Sample fee tier structure comparison between exchanges.

FAQ

1. How do fee tiers affect perpetual futures profitability?

Fee tiers directly impact net profit. A scalper making hundreds of trades daily might lose all edge if trading on higher-fee tiers. Lower tiers amplify gains by reducing cumulative transaction costs.

2. Where can traders compare fee tiers across exchanges?

Most exchanges publish fee schedules on their websites. Aggregator tools and where to compare fee tier in different perpetual futures platforms resources also help professionals benchmark costs effectively.

3. What is the best way for professional traders to reduce fees?

The best method depends on strategy: high-frequency traders benefit from maker rebates, while swing traders save more through volume-based VIP tiers or token staking. Combining these approaches provides maximum cost efficiency.

Conclusion

Professional traders know that every basis point matters. Conducting a professional traders fee tier comparison is not just a cost-saving exercise—it’s a profitability multiplier. By comparing exchange schedules, calculating effective costs, and negotiating custom plans, professionals ensure they remain competitive in fast-moving markets.

The best results come from blending strategies: consolidate volume, maximize maker orders, and explore token-based discounts. This layered approach helps traders unlock the lowest possible costs while keeping strategies scalable.

If this guide helped you, share it with your trading network and leave a comment below with your experiences optimizing fee tiers. Let’s build a smarter, more cost-efficient trading community together.

Do you want me to also build a side-by-side fee tier comparison table (with realistic example numbers) to make the article even more visually compelling and SEO-friendly?