=========================================================================

Swing trading offers experienced investors a powerful approach to capture short- to medium-term market moves while balancing risk and return. Unlike day trading, swing trading allows for holding positions over multiple days or weeks, enabling investors to leverage market volatility without the constant monitoring that intraday strategies require. This article provides a comprehensive guide for experienced investors looking to optimize their swing trading strategies, combining practical techniques, advanced methods, and market insights.

Understanding Swing Trading for Experienced Investors

Swing trading is a trading style focused on capturing price “swings” in financial markets. Experienced investors can use this approach to complement long-term portfolio strategies, taking advantage of short-term trends.

Key Characteristics of Swing Trading

- Time Horizon: Positions are typically held from several days to a few weeks.

- Technical Focus: Heavy reliance on chart patterns, technical indicators, and trend analysis.

- Market Selection: Suitable for stocks, ETFs, options, and futures markets.

- Risk Management: Employs stop-loss orders, position sizing, and portfolio diversification.

- Embedded Link: For deeper insights, investors can refer to how to identify swing trading opportunities, which explains how to pinpoint profitable entry and exit points.

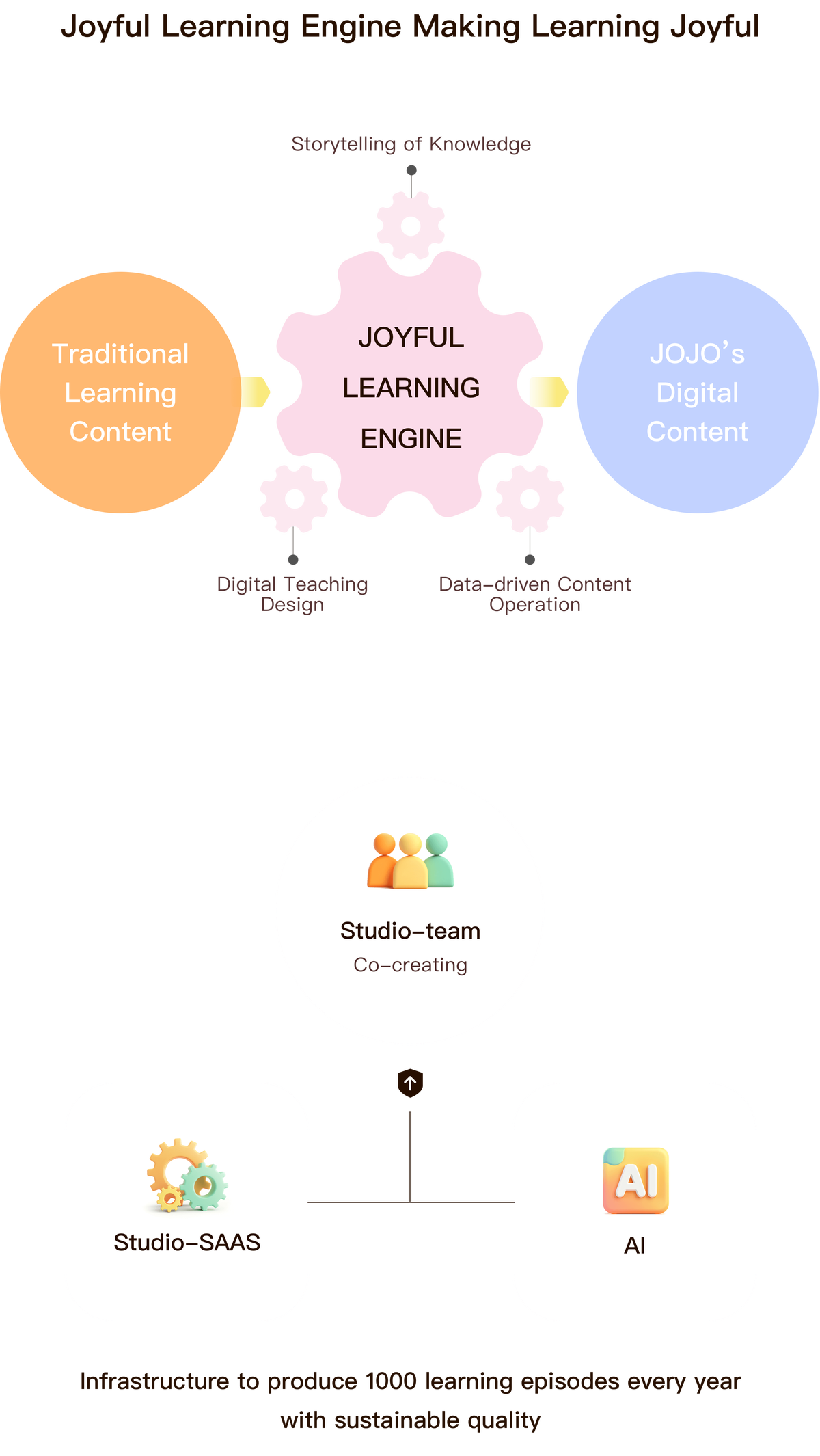

Visual representation of swing trading patterns and entry/exit points

Advanced Swing Trading Strategies

Experienced investors often employ advanced strategies that go beyond basic chart reading and technical indicators.

Strategy 1: Trend-Following Swing Trades

How It Works

Trend-following strategies focus on identifying sustained upward or downward movements. Traders enter positions in the direction of the primary trend, using pullbacks as ideal entry points.

- Indicators Used: Moving averages, MACD, and ADX.

- Pros: Capitalizes on large moves and reduces market noise impact.

- Cons: Can lead to missed reversals if trends shift suddenly.

Strategy 2: Mean Reversion Swing Trades

How It Works

Mean reversion strategies assume that price deviations from a perceived “average” level are temporary. Traders buy at support and sell at resistance levels.

- Indicators Used: Bollinger Bands, RSI, and stochastic oscillators.

- Pros: Effective in range-bound or consolidating markets.

- Cons: Risk of trend continuation losses if markets break out.

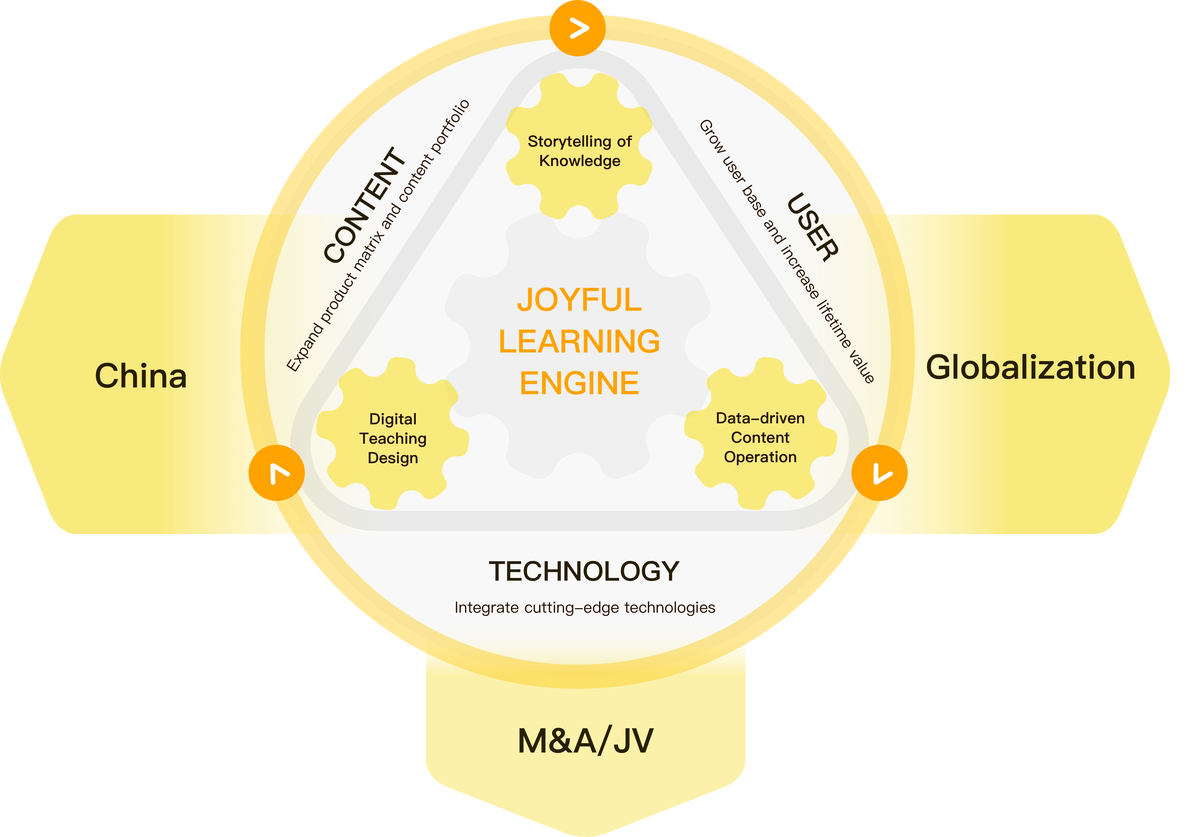

Comparing trend-following and mean reversion approaches

Swing Trading Tools and Technical Analysis

Advanced swing traders leverage technical analysis and specialized tools to optimize timing and execution.

Essential Tools for Experienced Traders

- Charting Software: Interactive charts with pattern recognition and indicator overlays.

- Automated Alerts: Notifications when price reaches specific levels or patterns form.

- Volume Analysis Tools: Evaluates liquidity and participation to validate moves.

- Options and Futures Integration: Enables hedging and leverage opportunities.

- Embedded Link: Investors exploring derivatives can consult how to perform swing trading in perpetual futures for applying swing techniques to futures markets.

Risk Management and Portfolio Integration

Even for experienced traders, risk management remains crucial in swing trading.

Key Risk Management Techniques

- Stop-Loss Orders: Automatically exit trades to prevent large losses.

- Position Sizing: Adjust trade sizes based on volatility and risk tolerance.

- Portfolio Diversification: Combine swing trades with long-term investments to balance risk.

- Scenario Planning: Prepare for unexpected market moves or gaps.

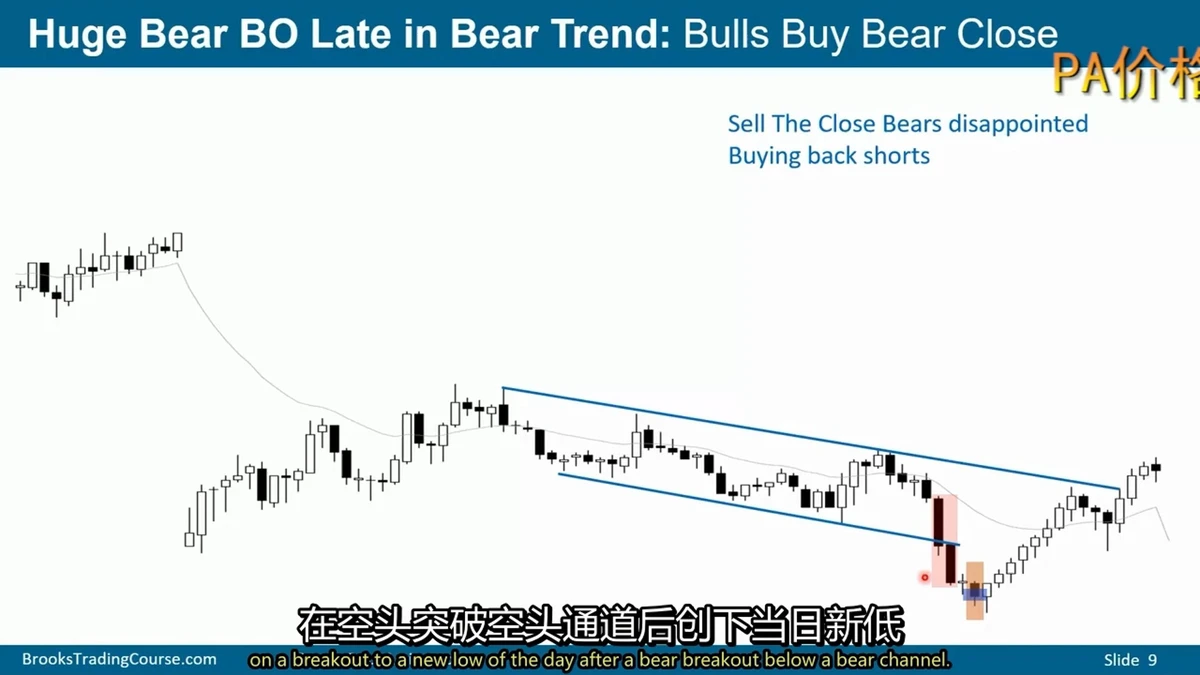

Risk management framework for swing trading portfolios

Comparing Swing Trading Approaches

| Strategy | Pros | Cons |

|---|---|---|

| Trend-Following | Captures strong directional moves | May miss reversals |

| Mean Reversion | Profitable in range-bound markets | Loses during breakouts |

| Technical + Derivatives | Leverage and hedging flexibility | Requires advanced knowledge |

| Discretionary Swing Trading | Flexibility in decision-making | Can be influenced by bias |

Real-World Examples

- Stock Swing Trade: Buying a tech stock during a bullish pullback and exiting after a two-week price rally.

- ETF Swing Trade: Trading sector ETFs using moving average crossovers for short-term trends.

- Futures Swing Trade: Applying trend-following techniques on perpetual futures to capitalize on intramarket swings.

FAQ

Q1: How does swing trading differ from day trading?

A1: Swing trading involves holding positions for several days or weeks, focusing on capturing medium-term trends, whereas day trading closes positions within the same day. Swing trading requires less constant monitoring but demands precise timing.

Q2: Can experienced investors automate swing trading strategies?

A2: Yes, traders can use algorithmic platforms to implement pre-defined entry and exit rules, combining indicators, risk management, and backtesting for consistent execution.

Q3: How do I select the right swing trading strategy for volatile markets?

A3: Trend-following strategies excel during sustained moves, while mean reversion works in consolidation phases. Advanced traders often combine both with technical indicators and market context to optimize results.

Conclusion

Swing trading offers experienced investors the ability to capitalize on market movements without the intensity of day trading. By combining trend-following and mean reversion strategies, leveraging technical tools, and implementing robust risk management, traders can enhance returns while managing risk. Continuous education, scenario analysis, and real-world application are essential for mastering swing trading and integrating it effectively into a diversified investment portfolio.

Call to Action: Share your swing trading success stories in the comments, and forward this article to peers looking to refine their advanced trading strategies.