===================================================

Perpetual futures are among the most actively traded derivatives in crypto markets, offering continuous exposure without expiry dates. However, their volatility, funding mechanisms, and liquidity structures make them challenging for manual trading. This is where top algorithm recommendations for perpetual futures come into play. Algorithms allow traders to execute precise, systematic, and risk-adjusted strategies in highly competitive markets.

This article provides a detailed exploration of the best algorithmic approaches for perpetual futures, compares their strengths and weaknesses, and offers practical insights into real-world use cases. Whether you’re a beginner or a professional quant, you’ll discover strategies that enhance efficiency, reduce emotional bias, and improve profitability.

Why Algorithms Are Essential in Perpetual Futures

The unique nature of perpetual futures makes algorithmic trading particularly valuable:

- 24⁄7 Markets: Perpetual futures trade around the clock. Algorithms ensure you never miss opportunities.

- High Leverage: With leverage often exceeding 50x, systematic risk management is crucial.

- Funding Rate Dynamics: Algorithms help optimize entry/exit to minimize costs or capture funding arbitrage.

- Volatility: Automated strategies react faster to market swings, reducing human error.

Professionals emphasize that why algorithms are essential in perpetual futures lies in their ability to process complex data and act in milliseconds, something no human can consistently achieve.

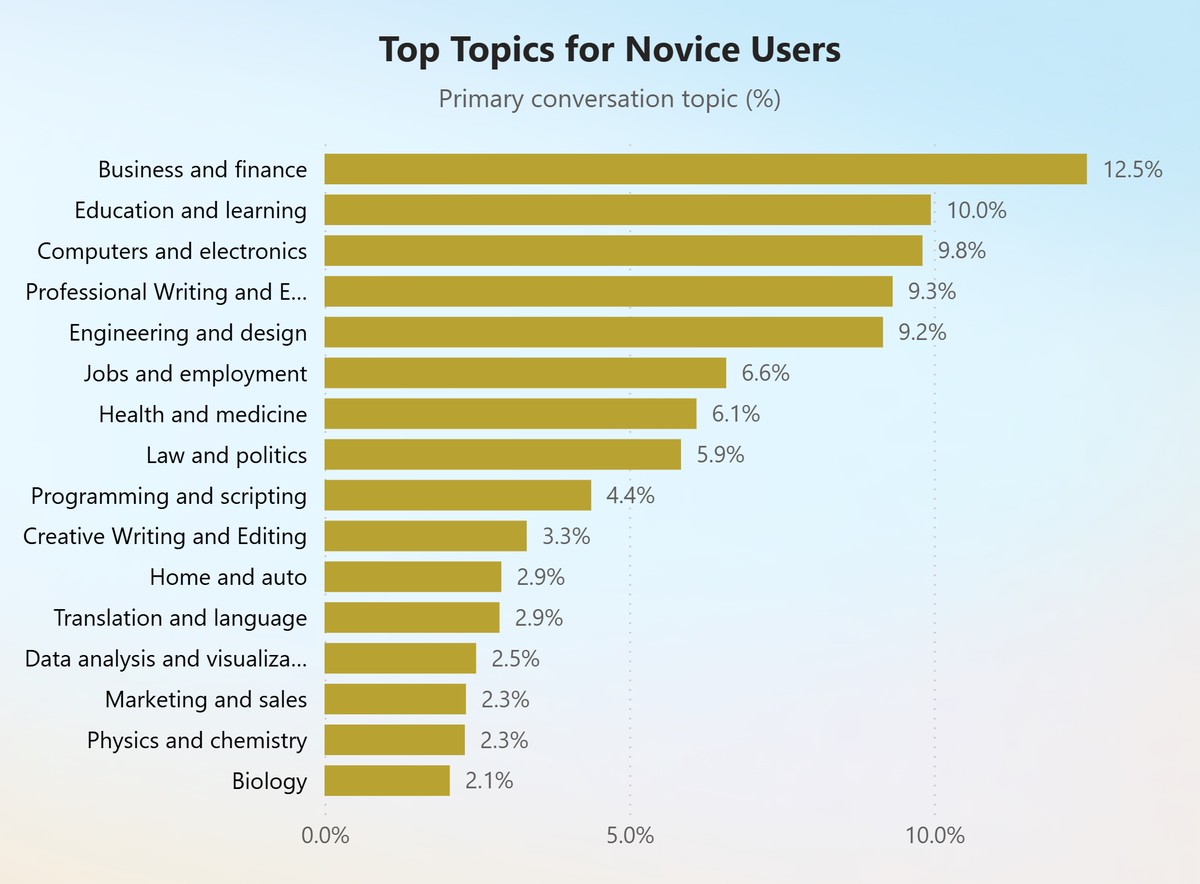

Key Factors for Selecting Algorithms in Perpetual Futures

Before reviewing strategies, traders should evaluate algorithms based on:

- Execution Speed: Latency-sensitive strategies demand ultra-low delay.

- Market Conditions: Trend-following works in strong markets, while mean-reversion suits sideways trends.

- Capital Allocation: Scalping requires more liquidity, while arbitrage may require larger balances.

- Risk Appetite: Conservative traders may prefer hedging, while aggressive ones adopt momentum-based strategies.

Key factors influencing algorithm selection in perpetual futures trading.

Top Algorithm Recommendations for Perpetual Futures

1. Trend-Following Algorithms

Description: These algorithms ride the momentum of markets by identifying sustained price movements. Common tools include moving averages, breakout detection, and momentum indicators.

Advantages:

- Profits from strong trends.

- Scalable across multiple markets.

- Easy to implement with standard indicators.

- Profits from strong trends.

Disadvantages:

- Performs poorly in ranging markets.

- Vulnerable to false breakouts.

- Performs poorly in ranging markets.

Best Use Case: Traders seeking medium- to long-term profits in trending crypto environments.

2. Mean-Reversion Algorithms

Description: These assume that prices eventually revert to their average after deviations. Tools include Bollinger Bands, Z-score analysis, and Ornstein-Uhlenbeck processes.

Advantages:

- Effective in sideways markets.

- Lower risk of large drawdowns compared to trend-following.

- Provides frequent trading opportunities.

- Effective in sideways markets.

Disadvantages:

- Loses in strong trending environments.

- Requires precise execution and tight stop-losses.

- Loses in strong trending environments.

Best Use Case: High-liquidity perpetual pairs (e.g., BTC/USDT, ETH/USDT) during consolidation phases.

3. Arbitrage Algorithms

Description: Exploit inefficiencies in price or funding across exchanges and instruments. Examples include funding rate arbitrage and cross-exchange arbitrage.

Advantages:

- Market-neutral and low directional risk.

- Consistent small profits.

- High scalability for institutional players.

- Market-neutral and low directional risk.

Disadvantages:

- Requires large capital and advanced infrastructure.

- High competition among professional firms.

- Requires large capital and advanced infrastructure.

Best Use Case: Hedge funds and institutional traders with access to multiple exchanges and large liquidity.

4. Market-Making Algorithms

Description: Provide liquidity by continuously quoting buy/sell prices, earning the bid-ask spread while managing inventory risk.

Advantages:

- Generates steady income in active markets.

- Benefits from exchange fee rebates.

- Enhances market depth.

- Generates steady income in active markets.

Disadvantages:

- Requires constant monitoring of inventory exposure.

- Susceptible to sudden volatility spikes.

- Requires constant monitoring of inventory exposure.

Best Use Case: Professional traders with sophisticated risk controls and co-location services.

5. Funding Rate Exploitation Algorithms

Description: Focus on capturing predictable gains from funding payments by holding long/short positions across perpetual and spot/futures.

Advantages:

- Exploits a unique feature of perpetual futures.

- Works in both bull and bear markets.

- Often uncorrelated with price direction.

- Exploits a unique feature of perpetual futures.

Disadvantages:

- Lower returns compared to directional strategies.

- Requires large notional size for meaningful profits.

- Lower returns compared to directional strategies.

Best Use Case: Traders with stable capital bases looking for lower-risk yield strategies.

Comparison of different algorithmic approaches in perpetual futures.

Comparing Algorithm Strategies: Which Is Best?

- For Beginners: Mean-reversion and trend-following strategies offer simplicity and easier implementation.

- For Professionals: Arbitrage and market-making provide sustainable alpha but require infrastructure.

- For Yield-Oriented Investors: Funding rate strategies provide steady returns with lower volatility.

In practice, many traders adopt a hybrid model, combining trend-following for directional exposure with arbitrage or funding-based strategies for stability.

This reflects the growing industry trend that emphasizes how algorithms impact perpetual futures strategy, making diversification across methods a necessity.

Implementation Insights

When considering how to use algorithm for perpetual futures, traders should:

- Backtest Thoroughly: Use historical funding rates and order book data to evaluate performance.

- Simulate Live Environments: Paper-trade before deploying real capital.

- Incorporate Risk Controls: Implement stop-loss, maximum drawdown, and position sizing rules.

- Optimize Continuously: Markets evolve—algorithms must adapt.

Best Practices for Algorithm Optimization

- Use multi-timeframe signals to avoid false entries.

- Integrate machine learning for predictive volatility modeling.

- Automate funding cost analysis to adjust positions dynamically.

- Monitor latency and slippage to improve execution efficiency.

These practices highlight ways to optimize algorithm for perpetual futures, ensuring strategies remain robust under shifting market regimes.

FAQs About Algorithms for Perpetual Futures

1. What is the most profitable algorithm for perpetual futures?

There is no single “most profitable” algorithm—it depends on market conditions. Trend-following works in strong rallies, while arbitrage excels in efficient markets. A diversified approach is often best.

2. Can beginners use algorithms for perpetual futures?

Yes. Beginners can start with simple moving average crossovers or Bollinger Band strategies. Over time, they can scale to advanced techniques like market-making or arbitrage.

3. How do I minimize risks when trading perpetual futures with algorithms?

Implement strict risk management: limit leverage, use stop-loss orders, diversify across strategies, and continuously monitor funding costs. Risk-adjusted returns matter more than raw profits.

Conclusion: Building a Winning Algorithmic Approach

The landscape of perpetual futures demands precision, speed, and adaptability. By applying top algorithm recommendations for perpetual futures, traders can navigate volatility, reduce risk, and enhance returns.

From trend-following to arbitrage, each algorithmic approach has unique strengths. The best results often come from strategic combinations tailored to capital size, risk profile, and market structure.

Real-time algorithmic trading dashboard for perpetual futures markets.

💡 Found this guide useful? Share it with your trading community, drop a comment with your algorithmic experiences, and start a discussion on the future of perpetual futures strategies!