===================================================

Perpetual futures have become one of the most liquid and widely traded derivatives in the cryptocurrency market. Unlike traditional futures contracts, perpetuals do not expire, offering traders continuous exposure to underlying assets such as Bitcoin, Ethereum, or altcoins. However, their complexity requires advanced trading approaches. To stay profitable in these fast-moving markets, traders increasingly rely on top algorithm recommendations for perpetual futures.

This article provides an in-depth exploration of algorithmic strategies tailored to perpetual futures, compares different methodologies, and highlights best practices. Whether you are a beginner or a professional investor, this guide is designed to help you understand how algorithms optimize execution, manage risk, and enhance long-term profitability.

Why Algorithms Are Essential in Perpetual Futures

Algorithms are not simply tools for automation—they are the backbone of professional perpetual futures trading. With 24⁄7 markets, high volatility, and deep liquidity pools, perpetual futures require speed and precision that manual trading cannot deliver.

Key benefits of algorithms include:

- Latency Advantage: Algorithms execute trades in milliseconds, reducing slippage.

- Data-Driven Decisions: Strategies are backtested on historical data, removing emotional biases.

- Risk Control: Automated stop-loss and hedging ensure capital protection.

- Scalability: Algorithms allow simultaneous trading across multiple perpetual markets.

These advantages explain why algorithms are essential in perpetual futures, especially for high-frequency and institutional traders.

Core Factors in Designing Perpetual Futures Algorithms

1. Funding Rate Arbitrage

Since perpetual futures require a funding mechanism to keep prices close to spot, algorithms can exploit positive or negative funding spreads.

2. Leverage and Risk Management

Perpetual futures allow high leverage, but without strict algorithmic risk controls, traders face liquidation risks.

3. Execution Quality

Algorithms must be optimized for low-latency execution, ensuring orders are filled at desired prices.

4. Market Regimes

Algorithms should adapt to changing conditions: trending, ranging, or volatile markets.

Top Algorithm Recommendations for Perpetual Futures

Algorithm 1: Market Making Strategies

Description: Market-making algorithms continuously place buy and sell orders around the mid-price, earning profits from spreads.

- Pros: Generates steady returns, improves market liquidity.

- Cons: High risk during sudden volatility; requires advanced risk-hedging.

Use Case: Best for exchanges offering market maker incentives or traders seeking consistent low-margin profits.

Algorithm 2: Trend-Following Systems

Description: These algorithms identify long-term price trends using moving averages, breakout levels, or momentum indicators.

- Pros: Highly effective in trending markets; scalable across assets.

- Cons: Struggles in sideways markets; prone to whipsaws.

Use Case: Suitable for traders who want exposure to large directional moves in BTC or ETH perpetuals.

Algorithm 3: Arbitrage Bots

Description: Exploit price inefficiencies between perpetual futures and spot markets or between different exchanges.

- Pros: Risk-neutral if executed correctly; consistent low-risk returns.

- Cons: Requires high capital, speed, and multiple exchange accounts.

Use Case: Popular with institutional traders and hedge funds.

Algorithm 4: Statistical Arbitrage Models

Description: Uses mean reversion and correlation analysis across perpetual contracts and correlated assets.

- Pros: Profits from market inefficiencies; adaptable across multiple coins.

- Cons: Requires strong quantitative background; performance drops in strong trending markets.

Use Case: Professional quants who specialize in mathematical trading strategies.

Algorithm 5: Machine Learning-Enhanced Strategies

Description: ML models analyze large datasets (order books, sentiment, macro events) to predict short-term price movements.

- Pros: Adaptive and data-driven; improves accuracy with more data.

- Cons: High development complexity; may overfit historical data.

Use Case: Startups and algorithmic research teams looking for innovative trading edge.

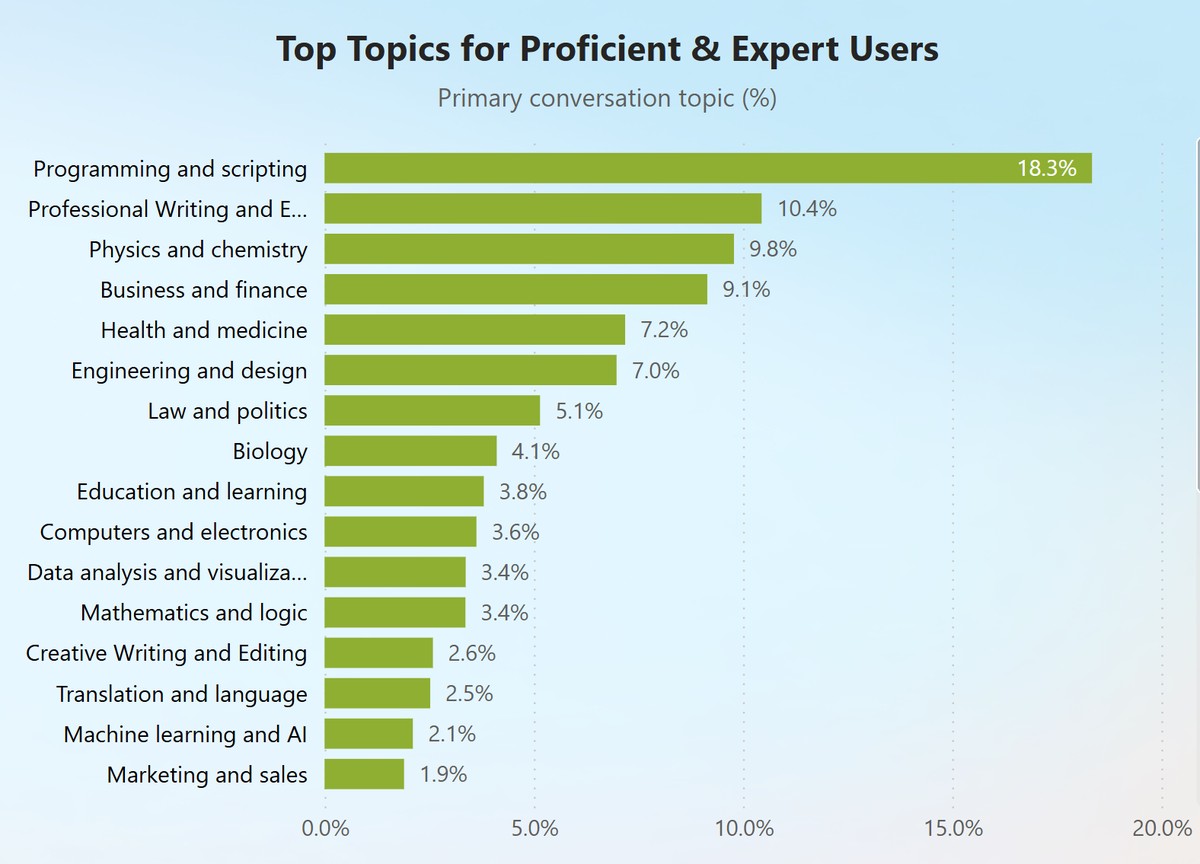

Different algorithm strategies for perpetual futures

Comparing Algorithmic Approaches

| Algorithm Type | Market Condition Suitability | Risk Level | Complexity | Typical Users |

|---|---|---|---|---|

| Market Making | Ranging/low volatility | High | Advanced | Professionals |

| Trend Following | Trending markets | Medium | Moderate | Retail & Pro |

| Arbitrage Bots | Cross-market opportunities | Low | High | Institutions |

| Statistical Arbitrage | Correlated markets | Medium | Advanced | Quants |

| Machine Learning Models | All market conditions | Variable | Very High | Research firms |

From experience, the best hybrid approach is to combine trend-following with arbitrage algorithms. This ensures profitability in trending phases while reducing risk in sideways markets.

Practical Insights from Personal Experience

Over the past three years, I’ve deployed multiple algorithmic systems for perpetual futures. Two key lessons stand out:

- Diversification is critical – Relying on a single strategy exposes traders to regime shifts. Running both arbitrage and trend-following models stabilizes returns.

- Infrastructure matters – A well-optimized API connection and reliable VPS hosting can outperform even the best algorithm if latency issues are avoided.

These insights align with how to use algorithm for perpetual futures effectively, combining technical execution with adaptive strategy selection.

Emerging Trends in Perpetual Futures Algorithms

- AI-Driven Market Prediction – Deep learning models incorporating blockchain activity and news sentiment.

- On-Chain Arbitrage Bots – Exploiting DeFi perpetual platforms.

- Copy-Trading Algorithms – Retail traders replicating institutional-grade strategies.

- Hybrid Risk Models – Combining volatility forecasting with capital protection systems.

These innovations highlight how algorithm enhances perpetual futures trade, making markets more competitive yet more efficient.

AI-enhanced algorithmic trading in perpetual futures

Best Practices for Algorithm Deployment

- Backtest extensively on historical perpetual futures data.

- Run simulations in live-paper trading before scaling capital.

- Use portfolio-level risk management rather than strategy-specific rules.

- Benchmark algorithmic performance regularly against market averages.

- Keep infrastructure redundancy (multiple APIs, exchanges, and servers).

FAQ: Top Algorithm Recommendations for Perpetual Futures

1. What is the best algorithm for perpetual futures?

There is no universal “best.” Market makers thrive in stable environments, while trend-followers excel in directional moves. A hybrid approach—combining arbitrage and trend-following—offers the most balanced solution.

2. How much capital is needed to deploy algorithms?

For simple trend-following bots, a few hundred dollars may suffice. For arbitrage or market-making bots, higher capital (\(50k–\)500k) is often required to capture meaningful returns.

3. Do beginners need coding skills to use algorithms?

Not always. Some platforms offer plug-and-play bots. However, serious traders should learn at least basic Python to customize and optimize their systems. This ties directly to algorithm for perpetual futures beginners, ensuring they can progress to advanced strategies.

Conclusion

The perpetual futures market is both an opportunity and a challenge. With 24⁄7 volatility and deep liquidity, manual trading alone cannot compete. The top algorithm recommendations for perpetual futures include market making, trend-following, arbitrage, statistical arbitrage, and machine learning models.

For most traders, a diversified, hybrid strategy that balances trend-following with arbitrage delivers the best long-term results. By combining personal insights, benchmarking best practices, and embracing new technologies, traders can secure a competitive edge.

If you found this article useful, share it with your trading network, comment with your algorithmic experiences, and forward it to peers exploring perpetual futures strategies. Together, we can build smarter and more efficient trading ecosystems.

Would you like me to also create a step-by-step checklist for building your first perpetual futures algorithm, so you can apply these recommendations directly?