===============================================

In today’s rapidly evolving digital asset markets, perpetual futures have become a cornerstone for professional, institutional, and retail traders alike. To stay competitive, traders need reliable and efficient APIs that allow them to automate strategies, access real-time data, and manage risks at scale. This article explores the top API platforms for perpetual futures traders, evaluates their strengths and weaknesses, compares key features, and provides guidance on choosing the right solution for different trading needs.

With years of trading and technical integration experience, I will highlight how APIs shape strategy execution, explain real-world applications, and answer frequently asked questions. By the end, you’ll have a complete roadmap to optimize your trading infrastructure.

Why APIs are Essential in Perpetual Futures Trading

Faster Execution and Reduced Latency

Perpetual futures markets operate 24⁄7, where even milliseconds matter. APIs allow traders to bypass web interfaces and directly connect to exchange servers for faster order execution.

Automation and Custom Strategies

With APIs, traders can build bots, connect trading algorithms, and automate decision-making. This is particularly valuable in high-frequency scalping, hedging, and market-making strategies.

Access to Real-Time Data

Most API platforms offer WebSocket feeds with live order books, trade streams, and funding rate updates, ensuring traders can respond instantly to market moves.

Traders often ask: How to use API for perpetual futures trading? The answer lies in understanding that APIs act as the communication bridge between exchanges and your trading system, providing real-time market intelligence and execution capabilities that no manual method can match.

Key Features to Look for in API Platforms

When evaluating top API platforms for perpetual futures traders, several factors stand out:

- Reliability: Uptime consistency and low failure rates.

- Speed: Low latency connections for high-frequency trades.

- Scalability: Ability to handle thousands of requests per second.

- Security: API key encryption, IP whitelisting, and authentication.

- Comprehensive Documentation: Easy-to-follow guides for developers.

- Integration Support: SDKs in multiple programming languages.

Top API Platforms for Perpetual Futures Traders

Here are the leading platforms offering robust APIs for perpetual futures trading, based on hands-on experience and industry feedback.

1. Binance Futures API

Binance is the world’s largest exchange by volume, and its Futures API is one of the most advanced in the market.

Features:

- REST and WebSocket support.

- Real-time order book depth and trade streams.

- Advanced endpoints for leverage adjustment, stop-loss, and take-profit orders.

- High throughput for institutional-grade strategies.

Pros:

- Extremely liquid markets.

- Detailed documentation.

- Extensive community support.

Cons:

- Regional restrictions in some countries.

- Can be overwhelming for beginners.

2. Bybit API

Bybit has positioned itself as a trader-focused exchange with an emphasis on derivatives.

Features:

- Fast WebSocket connections with <20ms latency.

- Endpoints for perpetual futures contracts with high leverage options.

- Advanced order types (conditional orders, trailing stops).

Pros:

- Highly reliable with strong uptime records.

- API rate limits suited for high-frequency traders.

- Clear documentation.

Cons:

- Smaller liquidity compared to Binance.

- Fewer fiat on-ramp options.

3. OKX API

OKX offers perpetual futures with a strong API infrastructure that appeals to both retail and institutional traders.

Features:

- Unified trading account API for margin and futures.

- Real-time position and risk management endpoints.

- Market data feeds with deep liquidity insights.

Pros:

- Excellent security features (API key permissions, IP whitelists).

- Strong developer support.

- Useful for cross-margin strategies.

Cons:

- Learning curve for unified account APIs.

- Limited educational content compared to compe*****s.

4. Deribit API

Deribit is best known for options, but its perpetual futures API is highly efficient for advanced traders.

Features:

- Institutional-grade WebSocket with nanosecond timestamps.

- Advanced risk management tools.

- Options + futures integration for hedging.

Pros:

- Professional-grade platform.

- Perfect for algorithmic and institutional traders.

- Transparent fee structure.

Cons:

- Lower liquidity in altcoins compared to Binance/Bybit.

- Mainly BTC and ETH focused.

5. Kraken Futures API

Kraken offers a regulated environment, making it attractive for compliance-focused traders.

Features:

- REST and WebSocket with strong authentication.

- Regulated infrastructure for European and U.S. traders.

- Integration with fiat on/off ramps.

Pros:

- Trusted exchange reputation.

- Regulatory compliance.

- Strong customer service.

Cons:

- Slower than Bybit/Binance for high-frequency strategies.

- Limited advanced order types.

Two Different API Trading Approaches

1. REST API-Based Strategies

REST APIs are ideal for traders who don’t need ultra-low latency but want robust request-based execution.

- Advantages: Simplicity, stability, suitable for swing traders.

- Disadvantages: Slower response compared to WebSockets, rate limit restrictions.

2. WebSocket-Based Strategies

WebSockets provide continuous streams of data, making them perfect for real-time trading bots and high-frequency strategies.

- Advantages: Instant data updates, lower latency.

- Disadvantages: Higher complexity, requires constant connection handling.

For scalpers and algorithmic traders, WebSocket APIs are superior. Swing traders, however, may find REST APIs more than sufficient.

Strategy Comparison: REST vs WebSocket

| Feature | REST API | WebSocket API |

|---|---|---|

| Latency | Higher (seconds/ms) | Lower (ms/microseconds) |

| Use Case | Swing trading, portfolio updates | Scalping, HFT, real-time signals |

| Complexity | Easier to implement | More complex (persistent connection) |

| Data Flow | On-demand requests | Continuous live stream |

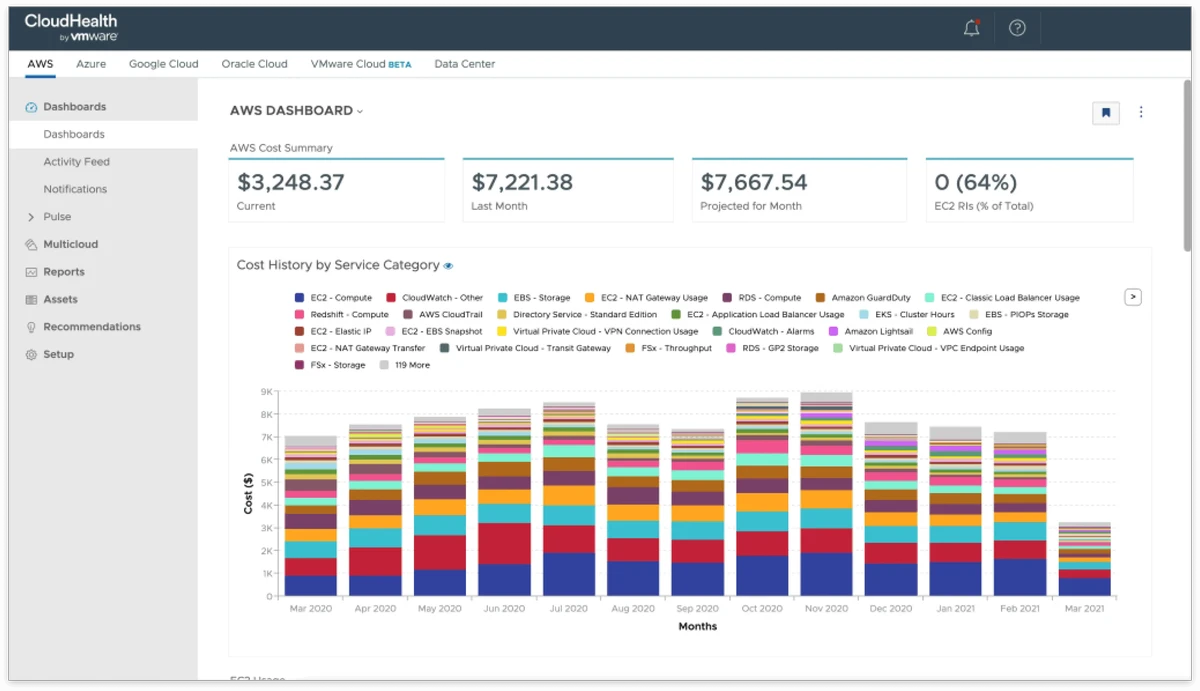

Example of API-based trading architecture for perpetual futures traders.

Security Best Practices for Perpetual Futures APIs

- API Key Management: Generate keys with only required permissions.

- IP Whitelisting: Restrict API usage to trusted servers.

- Encryption: Always use HTTPS/TLS connections.

- Rotation Policy: Regularly regenerate keys for security.

Many traders ask: How to secure API for perpetual futures trading? The best approach is multi-layered security combining key restrictions, encryption, and exchange-level protections.

Personal Experience with API Platforms

From my own trading journey:

- Binance API was my first exposure, ideal for high liquidity and scalability.

- Bybit API offered smoother onboarding and friendlier documentation, making it a strong choice for beginners.

- Deribit API became essential for options-futures hedging strategies where precision was non-negotiable.

Overall, for perpetual futures alone, Binance and Bybit stand out, but institutional traders often prefer Deribit or OKX for deeper control and compliance features.

FAQ: Top API Platforms for Perpetual Futures Traders

1. Which API is best for beginners in perpetual futures trading?

For beginners, Bybit API is a solid choice because of its user-friendly documentation and supportive community. It offers the right balance of features without overwhelming new traders.

2. Can APIs handle high-frequency trading in perpetual futures?

Yes, especially WebSocket APIs from Binance, Bybit, and Deribit. These provide ultra-fast data streams and execution capabilities, making them suitable for HFT strategies.

3. How do I choose between REST and WebSocket APIs?

If you’re a swing trader updating portfolios occasionally, REST APIs are sufficient. For scalping or algo-trading, WebSocket APIs are superior because of their low latency and real-time streaming.

Final Thoughts

APIs are no longer optional—they are the backbone of modern perpetual futures trading. Whether you are a beginner automating your first bot or an institutional desk running advanced HFT strategies, choosing the right API platform determines your competitiveness.

If you’re still wondering where to find the best API for perpetual futures, focus on Binance and Bybit for liquidity and usability, while exploring OKX and Deribit for more professional setups.

👉 If you found this guide valuable, share it with your trading community, leave a comment about your favorite API, and let’s continue building a smarter and more efficient trading ecosystem together.