=================================================

Introduction

Perpetual futures contracts have become a cornerstone of cryptocurrency and derivatives trading because they allow traders to speculate without expiry dates. In this highly liquid market, turnover calculation methods in perpetual futures play a vital role in evaluating trading efficiency, market activity, and strategy performance. Turnover is not just a number—it is a critical metric that reflects how actively contracts are being bought and sold, directly influencing profitability, liquidity assessment, and risk management.

In this article, we will explore different turnover calculation methods, compare their advantages and limitations, and highlight practical applications for both retail and institutional traders. We will also integrate insights from algorithmic strategies, high-frequency trading, and personal experience to provide a comprehensive guide.

Why Turnover Matters in Perpetual Futures

Liquidity Measurement

Turnover is often used as a proxy for market liquidity. High turnover generally indicates tight bid-ask spreads, lower slippage, and better trade execution.

Profitability Assessment

Understanding turnover helps traders assess whether their strategies generate sufficient volume to cover transaction costs and funding fees. For example, how turnover impacts perpetual futures trading profits is a recurring question among professional traders.

Market Transparency

Turnover data gives insight into market activity and helps traders evaluate where major participants, such as market makers and institutions, are deploying capital.

Turnover Calculation Methods

1. Notional Turnover Method

The most widely used calculation method is notional turnover, which multiplies the number of contracts traded by the contract size and the underlying asset price.

Formula:

Turnover=Contracts×ContractSize×PriceTurnover = Contracts \times Contract Size \times PriceTurnover=Contracts×ContractSize×Price

Advantages:

- Straightforward and widely accepted.

- Useful for comparing trading activity across different instruments.

- Straightforward and widely accepted.

Disadvantages:

- Can exaggerate turnover during high volatility periods.

- May not reflect actual capital deployed if leverage is extremely high.

- Can exaggerate turnover during high volatility periods.

2. Margin-Based Turnover Method

This approach calculates turnover based on the margin (collateral) actually used in trades.

Formula:

Turnover=MarginUsed×LeverageTurnover = Margin Used \times LeverageTurnover=MarginUsed×Leverage

Advantages:

- Reflects actual capital committed.

- Useful for risk management and assessing trader exposure.

- Reflects actual capital committed.

Disadvantages:

- Requires transparency into margin data, which may not be publicly available.

- Difficult to standardize across exchanges.

- Requires transparency into margin data, which may not be publicly available.

3. Volume-Weighted Turnover

Some traders prefer calculating turnover based on volume-weighted averages, taking into account contract size, trade frequency, and liquidity depth.

Advantages:

- Provides a more accurate picture of actual trading dynamics.

- Helpful for high-frequency and algorithmic strategies.

- Provides a more accurate picture of actual trading dynamics.

Disadvantages:

- Computationally complex.

- Requires high-quality tick-by-tick market data.

- Computationally complex.

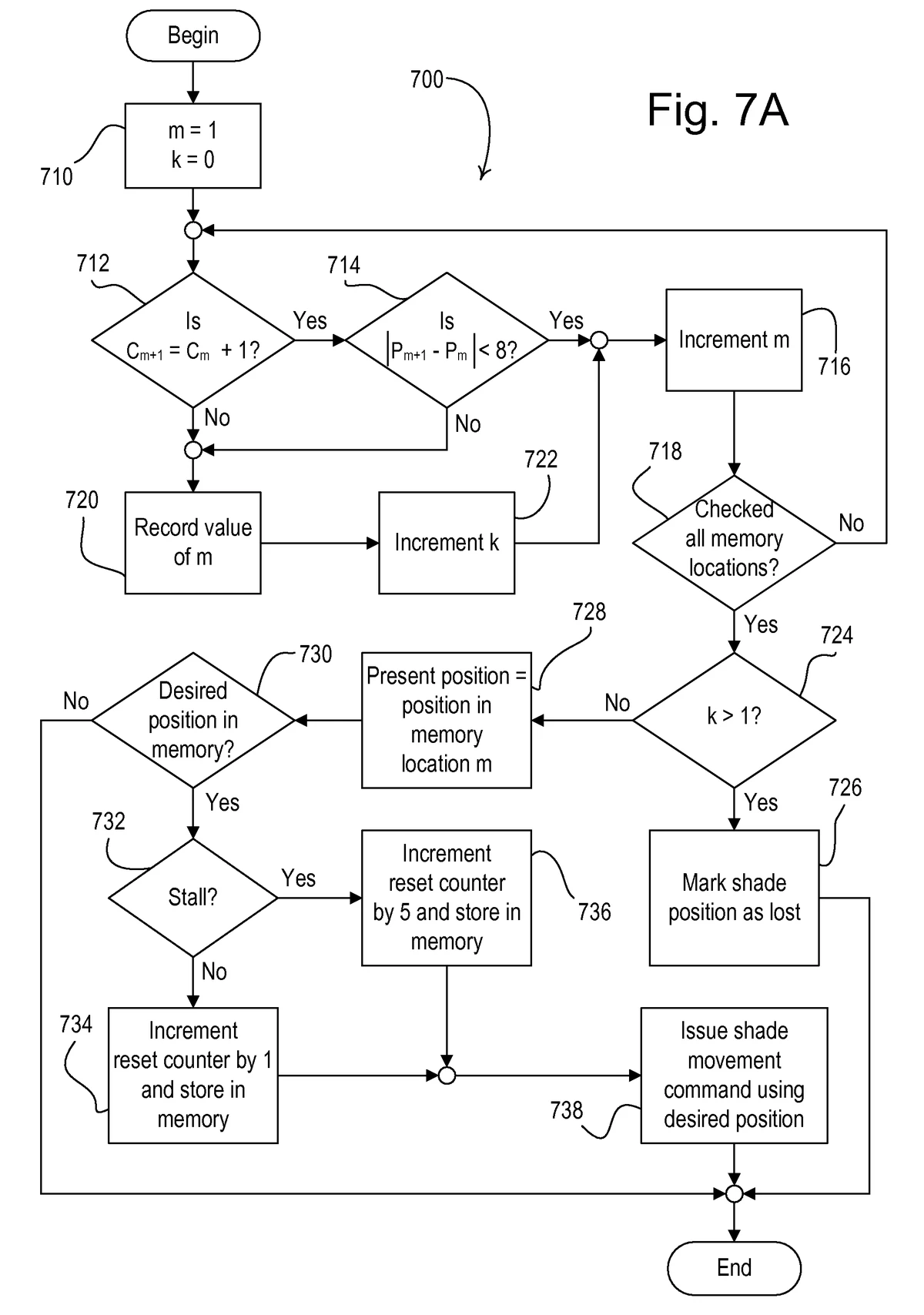

Turnover metrics visualization in perpetual futures markets

Comparing Methods: Which is Best?

- Retail Traders: For most retail traders, notional turnover is sufficient since it is transparent and easily accessible from exchanges.

- Institutional Traders: Margin-based turnover is more relevant for institutions managing large portfolios, as it reflects true capital efficiency.

- Algorithmic Traders: Volume-weighted methods are ideal, offering granular insights into micro-structure dynamics.

Recommended Approach

A hybrid turnover model is often the most effective, combining notional turnover for market comparisons and margin-based turnover for risk assessment. This dual approach helps traders balance accessibility and precision.

Industry Applications of Turnover Analysis

For Retail Traders

Retail traders often struggle with overtrading. Monitoring turnover helps ensure strategies are not excessively eroded by fees. Guides such as how to calculate turnover in perpetual futures can simplify this process.

For Institutional Investors

Institutions analyze turnover across markets to identify arbitrage opportunities, liquidity pools, and hedging strategies.

For Algorithmic and High-Frequency Traders

Turnover is a direct measure of execution efficiency. Strategies that rely on microsecond-level decisions need detailed turnover analysis for algorithmic trading in futures to optimize performance.

Key Factors Influencing Turnover

- Leverage Levels: Higher leverage increases effective turnover relative to capital committed.

- Market Volatility: Rapid price swings boost trading activity, inflating turnover.

- Exchange Incentives: Maker-taker fee structures encourage higher turnover.

- Market Participants: Professional traders and market makers typically generate higher turnover.

Practical Turnover Optimization Strategies

Reduce Costs

Choose exchanges with competitive fee structures. Turnover should be high enough to justify trading costs without eating into profits.

Adjust Position Sizes

Small, frequent trades often inflate turnover unnecessarily. Optimal sizing balances turnover with efficiency.

Use Analytics Tools

Platforms like TradingView, CryptoQuant, and exchange APIs provide turnover analysis dashboards. Many professional traders also build custom Python scripts to analyze turnover trends.

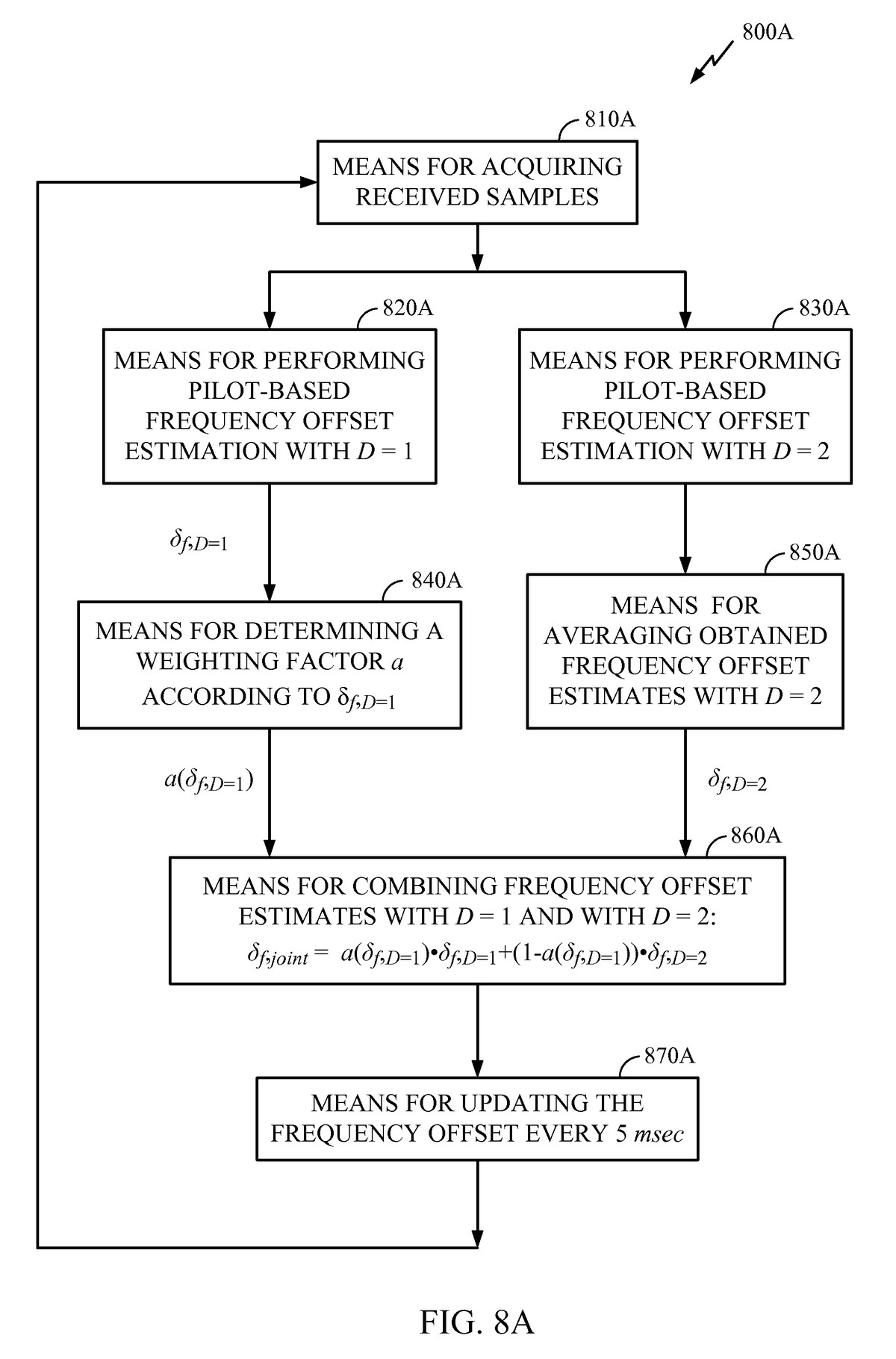

Flow of turnover calculation and monitoring for perpetual contracts

Personal Insights

From my experience, traders often overemphasize profit percentages without considering turnover. In reality, a profitable strategy on paper may underperform once fees and funding costs are factored in. Monitoring turnover alongside PnL helps identify whether strategies are scalable or merely noise-driven.

FAQ: Turnover in Perpetual Futures

1. What is the most accurate turnover calculation method?

No single method is universally “best.” Notional turnover is most common, but margin-based turnover provides a more accurate reflection of true capital efficiency. Combining methods often gives the clearest picture.

2. How does turnover affect profits in perpetual futures?

Turnover directly impacts fees and funding costs. High turnover without proportional profits can lead to net losses. Efficient strategies generate enough returns to justify turnover-driven costs.

3. Where can traders find reliable turnover data?

Most major exchanges, like Binance Futures and Bybit, publish real-time turnover data. Independent analytics providers also aggregate turnover across platforms for broader market analysis. For deeper insights, traders can explore where to analyze turnover metrics in perpetual markets.

Conclusion

Understanding turnover calculation methods in perpetual futures is essential for traders who want to optimize profitability, manage risk, and evaluate market efficiency. While notional turnover remains the most widely used, margin-based and volume-weighted approaches provide valuable additional perspectives.

The most effective strategy combines multiple methods, adapting them to trading style and capital structure. Whether you are a retail investor, institutional trader, or algorithmic strategist, turnover analysis is not just a technical metric—it is a key to sustainable success in perpetual markets.

Turnover optimization strategies in perpetual futures markets

If you found this guide valuable, share it with your trading network, comment with your own turnover insights, and join the discussion on mastering perpetual futures strategies.