=========================================================================================

For risk-averse investors, balancing returns with risk is critical. The Sharpe Ratio is one of the most widely used metrics in finance to evaluate risk-adjusted performance. This article provides a comprehensive Sharpe Ratio analysis for risk-averse investors, exploring its calculation, strategic applications, and how to integrate it into investment decision-making.

Understanding the Sharpe Ratio

What Is the Sharpe Ratio?

The Sharpe Ratio, developed by William F. Sharpe, measures excess return per unit of risk. It helps investors determine how much additional return they are receiving for the extra volatility endured.

Formula:

Sharpe Ratio=Rp−RfσpSharpe\ Ratio = \frac{R_p - R_f}{\sigma_p}Sharpe Ratio=σpRp−Rf

Where:

- RpR_pRp = Portfolio return

- RfR_fRf = Risk-free rate

- σp\sigma_pσp = Standard deviation of portfolio returns

Internal Reference: Why use Sharpe Ratio for evaluating risks explains why this metric is particularly valuable for risk-averse strategies.

Importance for Risk-Averse Investors

- Quantifies the risk-return tradeoff

- Allows comparison between different portfolios or strategies

- Identifies investments that offer efficient returns with minimal volatility

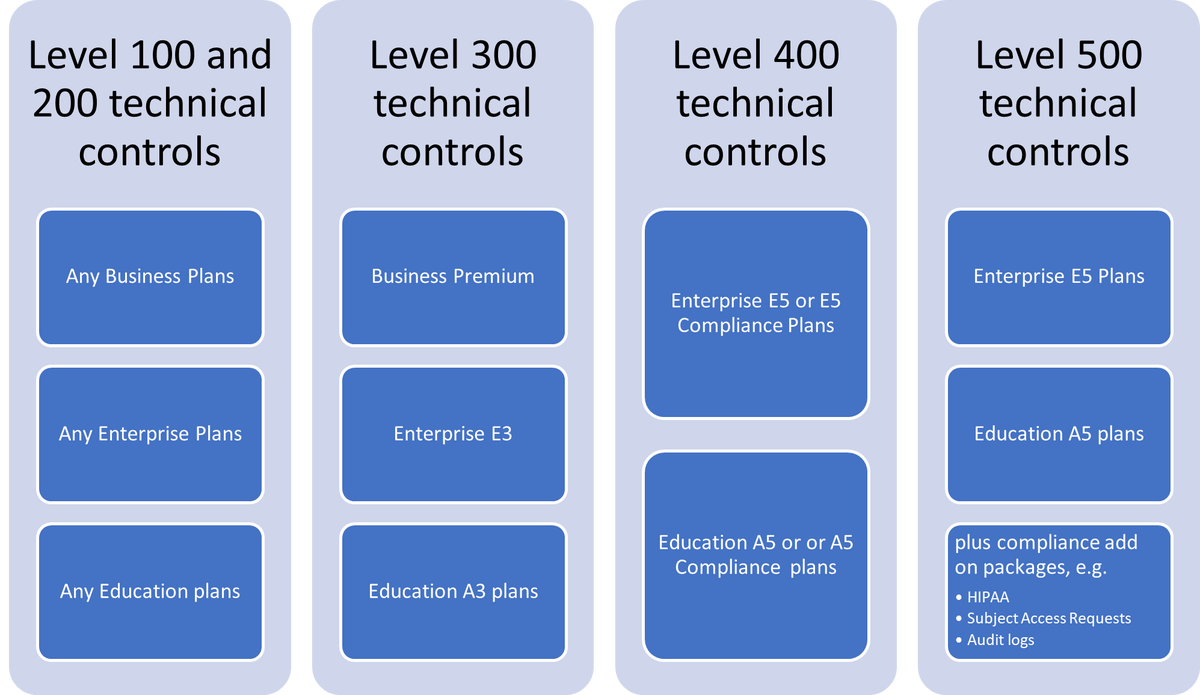

Illustration of Sharpe Ratio: risk-adjusted returns for different portfolios

Calculating Sharpe Ratio in Practice

Step 1: Gather Portfolio Data

- Collect historical returns of the portfolio or asset

- Determine the risk-free rate, often based on treasury yields

Step 2: Compute Mean Return and Standard Deviation

- Calculate average portfolio return over the chosen period

- Compute standard deviation to measure volatility

Step 3: Apply the Sharpe Ratio Formula

- Subtract risk-free rate from portfolio return

- Divide by standard deviation

- Interpret results: higher Sharpe = better risk-adjusted performance

Internal Reference: How to calculate Sharpe Ratio in perpetual futures provides step-by-step guidance for futures traders looking to evaluate risk-adjusted returns.

Sharpe Ratio in Different Investment Strategies

Method 1: Conservative Portfolio Optimization

Risk-averse investors often allocate assets to low-volatility instruments, such as bonds, dividend-paying stocks, and ETFs.

Strategy Highlights:

- Focus on minimizing portfolio standard deviation

- Moderate expected returns but higher Sharpe Ratio due to stability

- Useful for retirees, conservative mutual funds, and institutional investors

Method 2: Balanced Equity-Fixed Income Approach

Combining equities and fixed-income assets can yield moderate returns with manageable risk.

Strategy Highlights:

- Mix of growth and income assets

- Sharpe Ratio helps evaluate whether the additional equity exposure is justified

- Allows investors to dynamically adjust allocations based on risk tolerance

Comparison of Sharpe Ratios across conservative, balanced, and aggressive portfolios

Advanced Techniques for Risk-Averse Investors

Sharpe Ratio Optimization

- Volatility targeting: Adjust portfolio weights to maximize Sharpe Ratio

- Diversification: Combine uncorrelated assets to reduce portfolio standard deviation

- Dynamic rebalancing: Adjust positions as market conditions change to maintain optimal risk-adjusted returns

Comparing Sharpe Ratio Across Assets

- Equities vs Bonds: Equities may offer higher returns but more volatility

- ETFs vs Individual Stocks: ETFs can improve Sharpe Ratio through diversification

- Sharpe Ratio comparison ensures risk-adjusted performance is prioritized over raw returns

Real-World Application

Example 1: Evaluating a Conservative ETF Portfolio

- Portfolio expected return: 6%

- Risk-free rate: 2%

- Portfolio volatility: 4%

- Sharpe Ratio: (6%-2%)/4% = 1.0 → strong risk-adjusted return

Example 2: Comparing Multiple Equity Funds

- Fund A: Return 10%, Volatility 15%, Sharpe Ratio 0.53

- Fund B: Return 8%, Volatility 8%, Sharpe Ratio 0.75 → Fund B preferred for risk-averse investors

Sharpe Ratio Tools and Resources

Tools for Investors

- Online calculators and Excel templates

- Investment platforms with built-in Sharpe Ratio analysis

- Internal Reference: Where to find Sharpe Ratio analysis tools online lists platforms and resources for accurate calculations

Practical Tips

- Consider rolling Sharpe Ratio for dynamic evaluation

- Adjust for leverage or derivatives exposure

- Use in conjunction with other metrics like Sortino Ratio or maximum drawdown

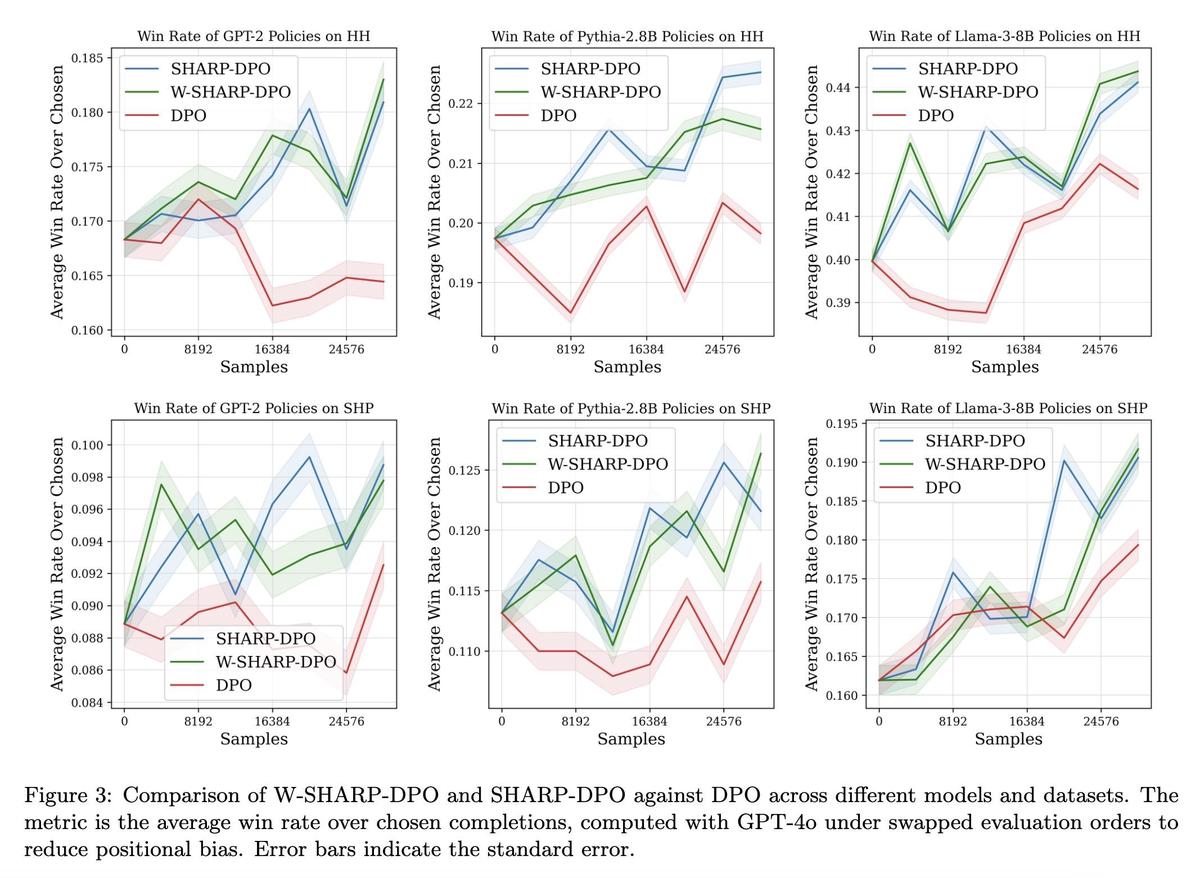

Step-by-step example of Sharpe Ratio calculation for a sample portfolio

FAQ

1. Can Sharpe Ratio be negative?

Yes. A negative Sharpe Ratio indicates that the risk-free rate exceeds portfolio returns, signaling poor risk-adjusted performance. Risk-averse investors should avoid portfolios with negative Sharpe values.

2. How often should I recalculate Sharpe Ratio?

- Monthly or quarterly recalculations are standard

- Frequent recalculations may be necessary for volatile markets or leveraged portfolios

3. Is a higher Sharpe Ratio always better?

While higher Sharpe is generally preferable, context matters:

- Extremely high Sharpe Ratios may indicate low volatility but stagnant growth

- Evaluate alongside expected returns and investment horizon

Conclusion

For risk-averse investors, Sharpe Ratio analysis is invaluable in constructing portfolios that maximize returns relative to risk. By integrating Sharpe Ratio insights, utilizing optimization techniques, and comparing across assets, investors can make informed decisions that protect capital while pursuing stable growth.

Engage with this article by sharing your experiences using Sharpe Ratio in your portfolios, commenting on techniques that worked for you, or forwarding it to other investors seeking risk-efficient strategies.