=======================================================================

The Sharpe Ratio is an essential metric for retail traders seeking to evaluate the risk-adjusted performance of their portfolios. By understanding and applying the Sharpe Ratio effectively, traders can make informed decisions, optimize strategies, and improve their long-term profitability. This comprehensive guide explores Sharpe Ratio fundamentals, calculation techniques, practical applications, and strategies to enhance performance.

Understanding the Sharpe Ratio

What is the Sharpe Ratio?

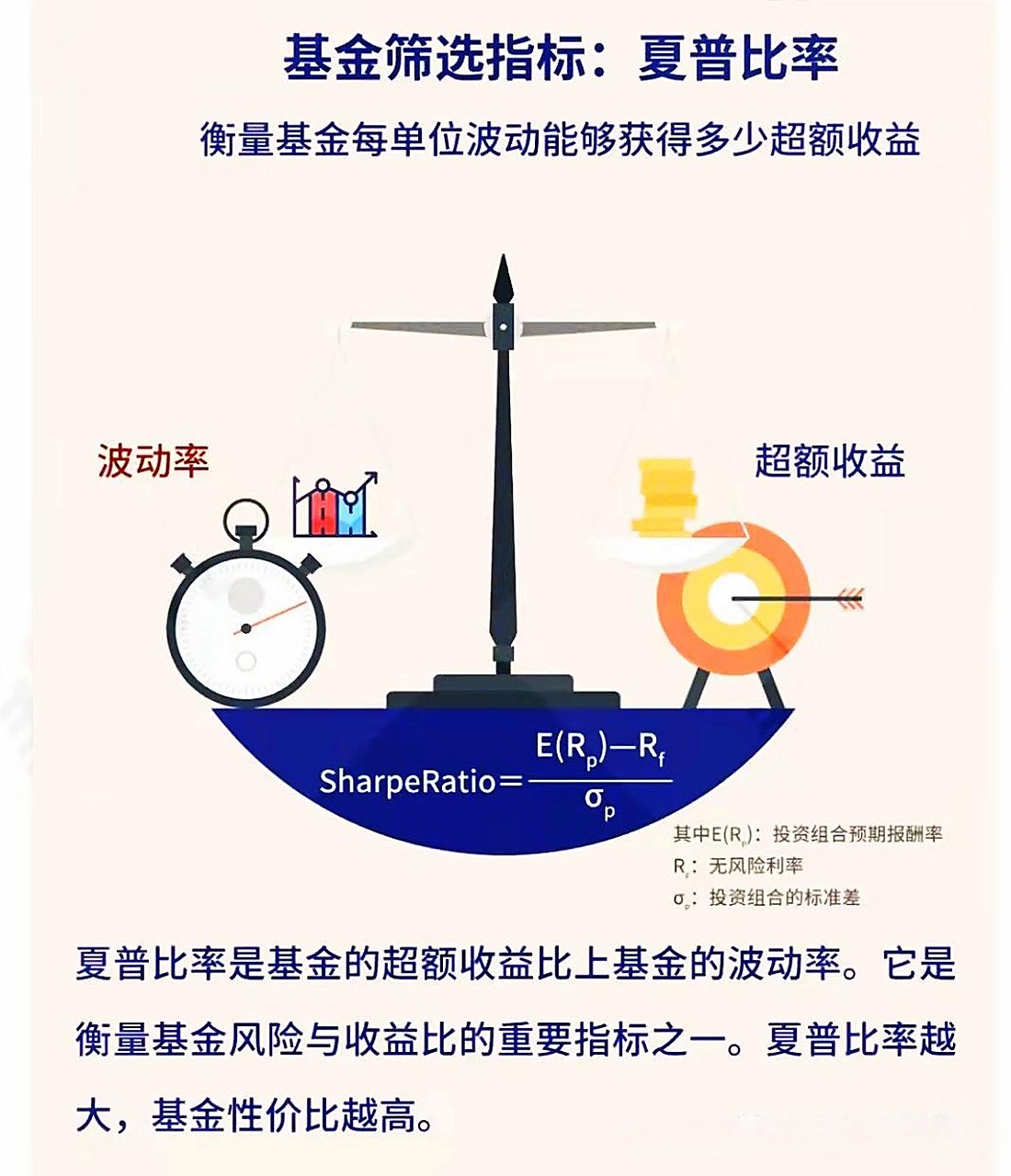

The Sharpe Ratio, developed by Nobel laureate William F. Sharpe, measures the excess return of an investment relative to its risk (standard deviation). The formula is:

Sharpe Ratio=Rp−RfσpSharpe\ Ratio = \frac{R_p - R_f}{\sigma_p}Sharpe Ratio=σpRp−Rf

Where:

- RpR_pRp = Portfolio return

- RfR_fRf = Risk-free rate

- σp\sigma_pσp = Standard deviation of portfolio returns

It quantifies how much return a trader receives for each unit of risk taken.

Importance for Retail Traders

Why use Sharpe Ratio for evaluating risks

Retail traders benefit from the Sharpe Ratio because it allows them to:

- Compare multiple trading strategies or assets objectively

- Identify risk-adjusted performance, not just absolute gains

- Avoid high-return but overly volatile positions

In essence, the Sharpe Ratio helps traders avoid being lured by profits that come with unsustainable risk levels.

Visual Aid: Sharpe Ratio Concept

Calculating the Sharpe Ratio

Step-by-Step Calculation

- Determine Portfolio Returns:

Collect historical daily, weekly, or monthly returns for your portfolio.

- Identify Risk-Free Rate:

Typically use government treasury yields corresponding to your investment horizon.

- Compute Excess Return:

Subtract the risk-free rate from your portfolio return.

- Calculate Standard Deviation:

Measure the variability of portfolio returns to assess risk.

- Compute Sharpe Ratio:

Divide excess return by standard deviation to obtain the risk-adjusted metric.

Sharpe Ratio tips for beginner traders

Beginners should start with simple portfolios (e.g., ETFs or mutual funds) to practice Sharpe Ratio calculation before applying it to complex strategies like leveraged futures or options.

Sharpe Ratio in Action: Example

Suppose a portfolio achieves 12% annual return with a standard deviation of 8%, and the risk-free rate is 2%.

Sharpe Ratio=12%−2%8%=1.25Sharpe\ Ratio = \frac{12\% - 2\%}{8\%} = 1.25Sharpe Ratio=8%12%−2%=1.25

A Sharpe Ratio above 1 indicates good risk-adjusted performance.

Visual Aid: Sharpe Ratio Calculation Example

Applying Sharpe Ratio to Trading Strategies

Evaluating Multiple Strategies

- Strategy Comparison: Use Sharpe Ratio to assess which trading approach offers superior risk-adjusted returns.

- Example: Compare swing trading, day trading, and algorithmic strategies based on historical Sharpe Ratios.

Where to find Sharpe Ratio analysis tools online

Retail traders can leverage platforms like TradingView, Portfolio Visualizer, or broker-provided analytics tools to compute Sharpe Ratios automatically and benchmark performance.

Sharpe Ratio in Perpetual Futures

How to calculate Sharpe Ratio in perpetual futures

For traders in perpetual futures:

- Use realized returns after funding rates

- Adjust for leverage to avoid overestimating performance

- Monitor standard deviation over the trading horizon

Applying Sharpe Ratio in futures allows traders to evaluate whether their leveraged positions are yielding sufficient risk-adjusted returns.

Visual Aid: Sharpe Ratio in Futures Trading

Strategies to Improve Sharpe Ratio

1. Diversification

- Allocate across uncorrelated assets or instruments

- Reduce portfolio volatility without sacrificing returns

- Incorporate different sectors, asset classes, or trading styles

Pros: Enhances risk-adjusted performance

Cons: Requires careful correlation analysis

2. Risk Management Techniques

- Implement position sizing and stop-losses

- Adjust leverage based on market volatility

- Regularly rebalance to maintain target risk levels

Pros: Prevents large drawdowns that negatively affect Sharpe Ratio

Cons: Requires discipline and monitoring

3. Strategy Optimization

- Backtest multiple entry/exit criteria

- Adjust indicators for higher consistency

- Combine trend-following and mean-reversion strategies for balance

Advanced Sharpe Ratio strategies for professionals

Professional traders optimize Sharpe Ratios by integrating algorithmic execution, high-frequency data analysis, and dynamic portfolio hedging.

Visual Aid: Improving Sharpe Ratio Through Diversification

Common Mistakes When Using Sharpe Ratio

- Ignoring Time Horizon: Short-term ratios may misrepresent risk

- Neglecting Leverage: Unadjusted leverage can inflate returns misleadingly

- Over-relying on Sharpe Ratio Alone: Complement with metrics like Sortino Ratio or Maximum Drawdown

FAQ

1. How can retail traders use Sharpe Ratio for daily trading?

Retail traders should compute daily or weekly Sharpe Ratios for their strategies to monitor risk-adjusted performance. This allows timely adjustments to position sizing, stop-losses, or strategy selection.

2. Can Sharpe Ratio be negative?

Yes. A negative Sharpe Ratio indicates the portfolio underperformed the risk-free rate on a risk-adjusted basis, signaling poor performance or excessive risk-taking.

3. What is a good Sharpe Ratio for retail investors?

- >1: Acceptable

- >2: Very good

- >3: Exceptional

These benchmarks vary based on asset class, time horizon, and trading style.

Conclusion

The Sharpe Ratio is an indispensable tool for retail traders seeking to balance risk and reward. By mastering its calculation, applying it to different strategies, and optimizing portfolios, traders can enhance long-term returns while controlling volatility. Whether using simple ETFs, perpetual futures, or algorithmic strategies, Sharpe Ratio insights provide clarity and actionable guidance.

Engage with this guide: share your experiences with Sharpe Ratio, comment on strategies that improved your risk-adjusted returns, and discuss how you integrate it into daily trading practices.

Do you want me to create a visual dashboard template for retail traders to track Sharpe Ratios across multiple strategies in real time? This can make monitoring risk-adjusted performance much easier.