=============================================================================

In today’s complex financial markets, achieving consistent returns while managing risk is a primary goal for traders and investors. One of the most effective tools to evaluate risk-adjusted performance is the Sharpe Ratio. This guide provides in-depth strategies on Sharpe Ratio improvement guides, helping traders optimize portfolios, measure performance accurately, and implement actionable improvements.

Understanding the Sharpe Ratio

What Is the Sharpe Ratio?

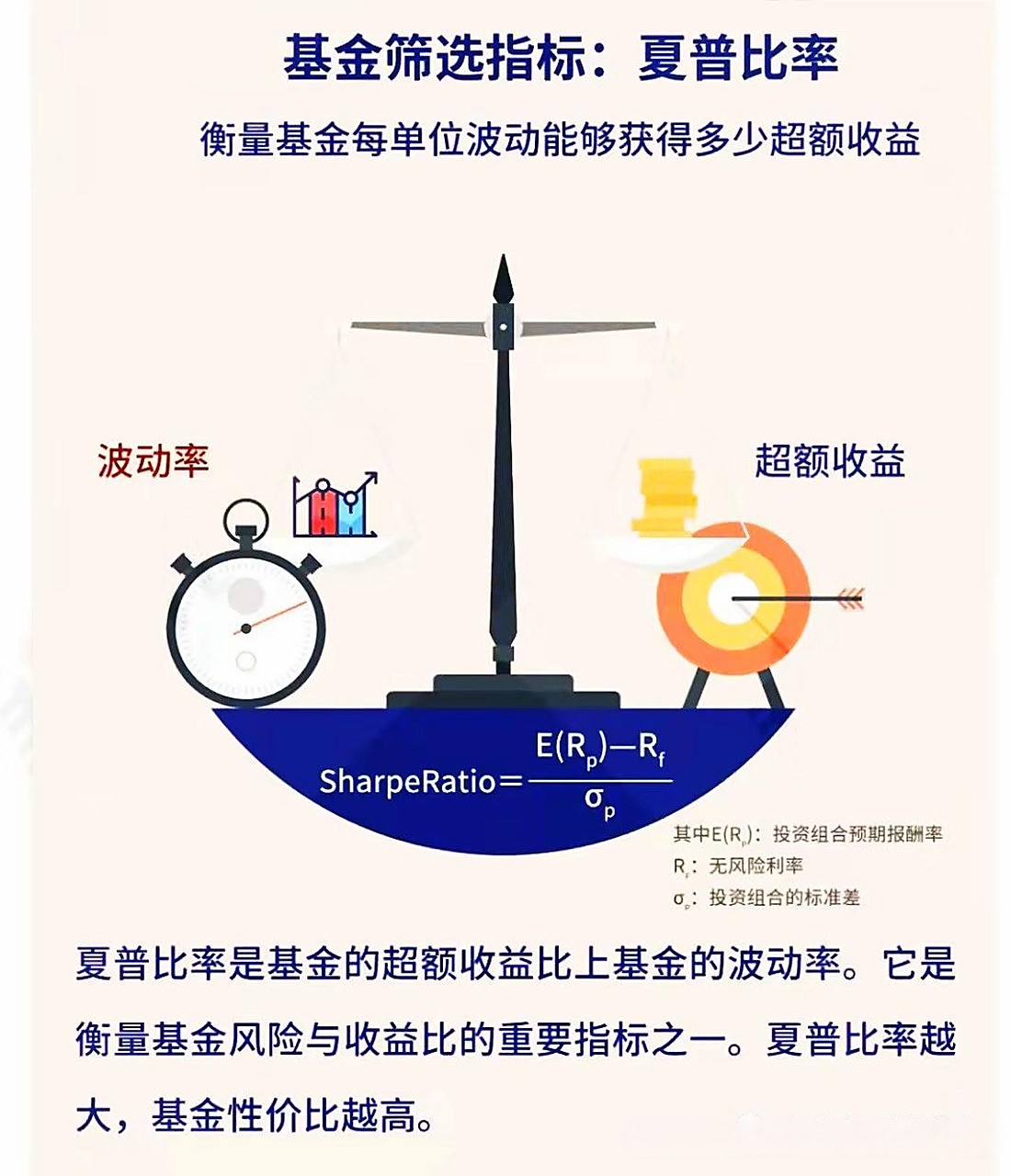

The Sharpe Ratio, developed by Nobel laureate William F. Sharpe, measures the performance of an investment compared to a risk-free asset, adjusting for its volatility. It is calculated as:

Sharpe Ratio=Rp−Rfσp\text{Sharpe Ratio} = \frac{R_p - R_f}{\sigma_p}Sharpe Ratio=σpRp−Rf

Where:

- RpR_pRp = Portfolio return

- RfR_fRf = Risk-free rate

- σp\sigma_pσp = Standard deviation of the portfolio’s excess return

Why use Sharpe Ratio for evaluating risks

The Sharpe Ratio is essential for understanding how much return an investor earns for each unit of risk taken. Higher values indicate better risk-adjusted returns, which is crucial in volatile markets such as futures or crypto.

Visual Aid: Sharpe Ratio Components

Why Sharpe Ratio Matters

Evaluating Performance Across Markets

Traders often need to compare returns across multiple instruments or asset classes. The Sharpe Ratio provides a standardized metric:

- Consistent benchmarking: Compare mutual funds, ETFs, or trading strategies.

- Risk-adjusted evaluation: Focus on performance relative to volatility, not just raw returns.

Where to apply Sharpe Ratio in trading strategies

Sharpe Ratio can guide asset allocation, identify underperforming strategies, and optimize trading models for better risk-adjusted performance.

Limitations to Consider

- Non-normal returns: The Sharpe Ratio assumes normal distribution, which may not hold in highly volatile markets.

- Time horizon sensitivity: Short-term ratios may not reflect long-term risk.

- Leverage distortion: High leverage can artificially inflate or deflate the ratio.

Methods to Improve Sharpe Ratio

Strategy 1: Portfolio Optimization

Improving Sharpe Ratio starts with adjusting portfolio composition:

Diversification Across Asset Classes

- Spread investments across equities, fixed income, commodities, and cryptocurrencies.

- Minimize correlation between assets to reduce portfolio volatility.

- Use historical correlation matrices to identify ideal diversification.

Risk Allocation Techniques

- Allocate capital based on volatility targets rather than equal weighting.

- Implement stop-loss and drawdown limits to protect downside.

Pros: Reduces portfolio risk, enhances stability

Cons: May limit exposure to high-return assets

Visual Aid: Diversified Portfolio Example

Strategy 2: Active Risk Management

Active strategies focus on controlling downside volatility without sacrificing returns.

Volatility-Based Position Sizing

- Increase positions during low volatility periods and reduce exposure during spikes.

- Apply metrics like Value at Risk (VaR) or Conditional VaR for precise sizing.

Hedging and Derivatives

- Use options, futures, or inverse ETFs to mitigate adverse movements.

- Hedging reduces portfolio variance, improving the Sharpe Ratio.

Pros: Enhances risk-adjusted returns, flexible

Cons: Complexity, potential costs from hedging instruments

How to improve Sharpe Ratio in futures

Implement volatility-adjusted position sizing and dynamic hedging strategies specifically tailored for futures markets to stabilize returns while maintaining exposure to high-performing instruments.

Strategy 3: Performance Measurement Adjustments

Fine-tuning measurement approaches can also improve the ratio:

- Adjust for risk-free rate variations: Using short-term Treasury rates may yield more accurate ratios.

- Use rolling Sharpe Ratios: Measure over multiple periods to smooth anomalies.

- Incorporate transaction costs: Reflect real-world trading costs in calculations.

Visual Aid: Rolling Sharpe Ratio Over Time

Comparing Sharpe Ratio Improvement Methods

| Method | Advantages | Disadvantages |

|---|---|---|

| Portfolio Optimization | Reduces overall volatility, long-term stability | May reduce high-return exposure |

| Active Risk Management | Improves short-term risk-adjusted returns | Requires expertise and monitoring |

| Performance Measurement Adjustments | Provides accurate evaluation | Does not directly enhance returns |

Advanced Techniques for Professionals

Algorithmic Enhancements

- Quantitative models: Use machine learning to optimize asset allocation dynamically.

- Scenario analysis: Stress-test portfolios under various market conditions.

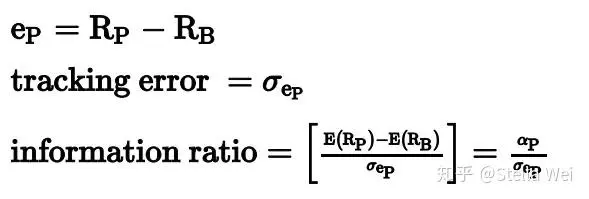

Integration with Other Metrics

- Compare Sharpe Ratio with Sortino Ratio, Omega Ratio, or Calmar Ratio to ensure a holistic view of performance.

- Avoid relying solely on Sharpe Ratio for high-leverage instruments.

Advanced Sharpe Ratio strategies for professionals

Incorporate volatility forecasting, dynamic hedging, and leverage adjustments for institutional-level risk management.

Visual Aid: Sharpe Ratio vs Other Metrics

FAQ

1. How often should I calculate the Sharpe Ratio?

Calculate periodically based on trading strategy and market conditions. Rolling monthly or quarterly evaluations provide insights into performance consistency.

2. Can high leverage reduce Sharpe Ratio?

Yes, excessive leverage increases portfolio volatility, which may lower the Sharpe Ratio. Risk management and position sizing are critical to maintain high risk-adjusted returns.

3. What tools help with Sharpe Ratio improvement?

- Portfolio management software like Bloomberg Terminal, Morningstar, or QuantConnect

- Online Sharpe Ratio analysis tools for tracking and benchmarking

- Custom spreadsheets integrating historical returns, volatility, and risk-free rates

Conclusion

Improving the Sharpe Ratio requires a combination of portfolio optimization, active risk management, and accurate performance measurement. By understanding the underlying principles, implementing diversification, controlling volatility, and using advanced tools, traders can enhance their risk-adjusted returns significantly.

Engage with this guide: share your own strategies, compare approaches with fellow traders, and explore how dynamic risk-adjusted methods can elevate trading performance.

Would you like me to also create a step-by-step Sharpe Ratio optimization checklist for traders to implement immediately in their portfolios?