=======================================

The Sharpe Ratio remains one of the most critical metrics in quantitative trading, offering a clear perspective on risk-adjusted returns. For quant traders, understanding, calculating, and applying the Sharpe Ratio is essential to evaluate strategies, optimize portfolios, and manage risk effectively. This article provides comprehensive insights into Sharpe Ratio insights for quant traders, explores different calculation methods, advanced strategies, and practical applications, ensuring both beginners and professionals can leverage its full potential.

Understanding the Sharpe Ratio

What is the Sharpe Ratio?

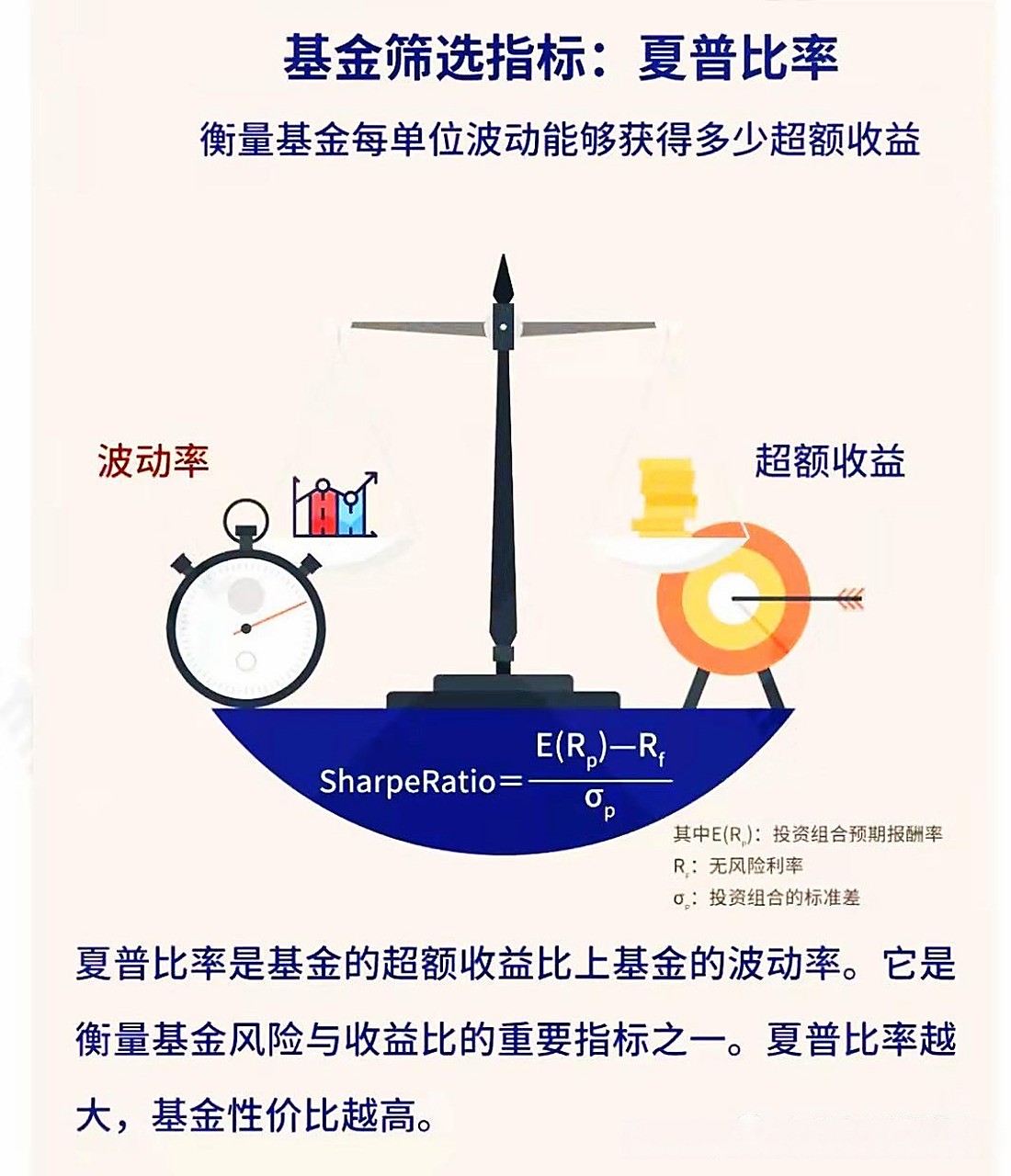

The Sharpe Ratio, developed by Nobel laureate William F. Sharpe, measures the excess return per unit of risk for an investment. Mathematically, it is expressed as:

SharpeRatio=Rp−RfσpSharpe Ratio = \frac{R_p - R_f}{\sigma_p}SharpeRatio=σpRp−Rf

Where:

- RpR_pRp = Portfolio return

- RfR_fRf = Risk-free rate

- σp\sigma_pσp = Standard deviation of portfolio returns

A higher Sharpe Ratio indicates better risk-adjusted performance, making it a key benchmark for comparing trading strategies.

Importance in Quantitative Trading

Quant traders rely on the Sharpe Ratio to evaluate algorithmic strategies, portfolio allocations, and risk-adjusted returns. Using the Sharpe Ratio allows traders to:

- Compare strategies on a risk-adjusted basis

- Identify over-leveraged or underperforming trades

- Optimize portfolios to maximize return per unit of risk

Internal Reference: Why is Sharpe Ratio crucial for perpetual futures explains the significance of Sharpe Ratio in high-frequency and derivatives trading.

Calculating Sharpe Ratio: Methods and Tools

Basic Calculation

For a simple portfolio, the Sharpe Ratio can be calculated using historical returns:

- Collect daily or monthly returns of the portfolio.

- Subtract the risk-free rate (e.g., treasury bills).

- Divide the excess returns by the standard deviation of returns.

Advanced Methods for Quant Traders

- Annualized Sharpe Ratio: Multiply daily or monthly Sharpe Ratios by 252\sqrt{252}252 or 12\sqrt{12}12 to annualize.

- Rolling Sharpe Ratio: Use rolling windows to track the performance and volatility over time.

- Monte Carlo Simulation: Simulate different market scenarios to estimate potential Sharpe Ratios under varying volatility conditions.

Tools for Calculation

Several platforms provide Sharpe Ratio calculators and analytics tools:

- Python libraries like pandas and numpy

- R packages for portfolio optimization

- Trading platforms like QuantConnect, MetaTrader, or Bloomberg

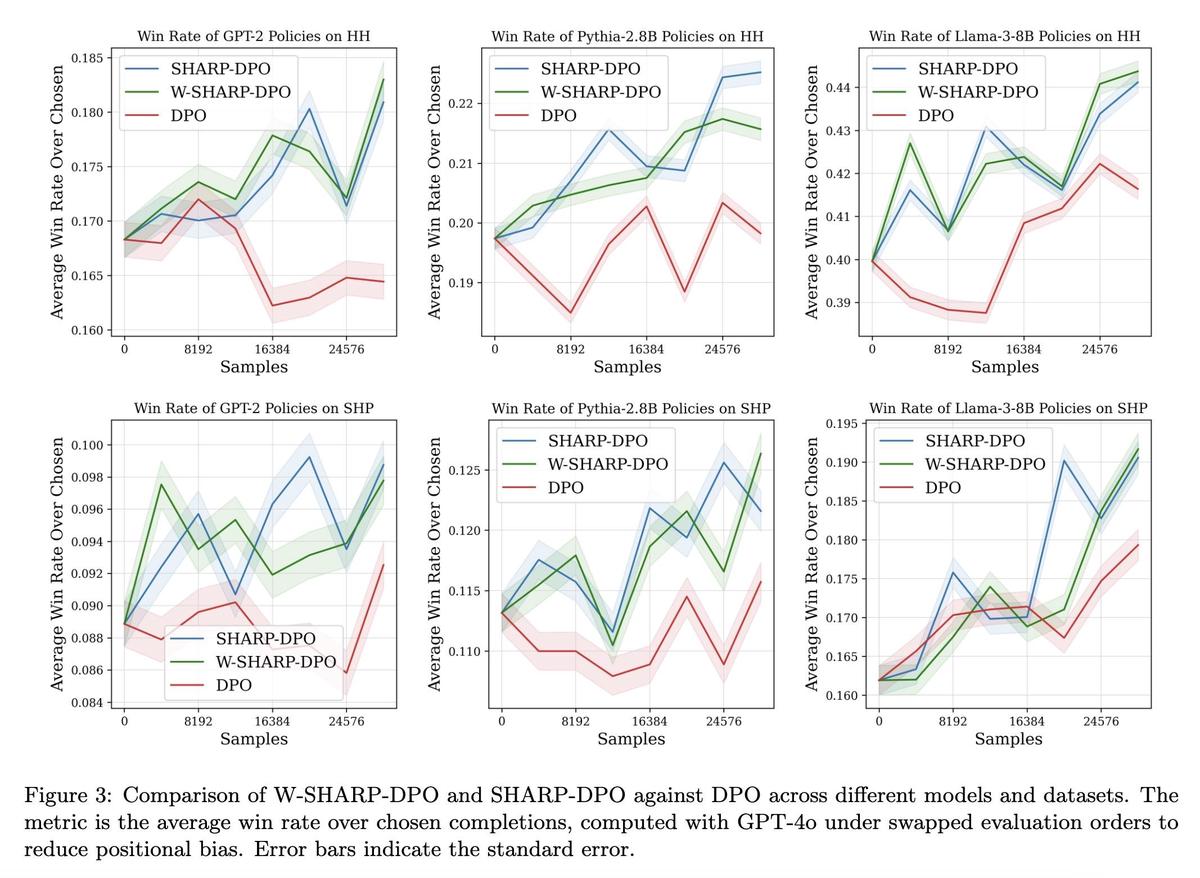

Visualization of Sharpe Ratio across different trading strategies over time.

Strategy 1: Sharpe Ratio Optimization in Portfolio Design

How It Works

Optimizing a portfolio based on the Sharpe Ratio involves maximizing risk-adjusted returns rather than absolute returns.

Execution Steps

- Collect historical returns for multiple assets.

- Estimate expected returns and volatility.

- Apply optimization algorithms (e.g., mean-variance optimization) to maximize Sharpe Ratio.

- Rebalance periodically to maintain optimal allocation.

Advantages

- Focuses on risk-adjusted growth

- Helps prevent over-leveraging in volatile markets

Disadvantages

- Sensitive to input assumptions (returns, volatility, correlation)

- Past performance may not predict future risk-adjusted returns

Strategy 2: Sharpe Ratio-Based Algorithmic Filtering

How It Works

Quant traders often integrate Sharpe Ratio thresholds into algorithmic strategies to filter out underperforming models.

Execution Steps

- Compute Sharpe Ratios for all candidate strategies.

- Set a minimum acceptable Sharpe Ratio threshold (e.g., 1.0 or higher).

- Only deploy strategies meeting the threshold in live trading.

- Continuously monitor and update based on rolling calculations.

Advantages

- Reduces deployment of high-risk or low-performing algorithms

- Quantitative and systematic approach to risk management

Disadvantages

- Requires continuous recalibration

- May exclude strategies that perform well in specific market conditions but show lower overall Sharpe

Internal Reference: How to calculate Sharpe Ratio in perpetual futures provides practical formulas and case studies for derivatives markets.

Factors Affecting Sharpe Ratio

Volatility and Market Conditions

Higher volatility increases the denominator of the Sharpe Ratio, potentially lowering the score even if returns remain strong.

Timeframe Selection

Daily, weekly, or monthly returns can produce different Sharpe Ratios. Traders must align calculation frequency with strategy horizons.

Correlation and Diversification

Diversified portfolios tend to have smoother returns, improving Sharpe Ratios compared to concentrated portfolios.

Comparison of Sharpe Ratios across different asset classes and trading strategies.

Advanced Sharpe Ratio Strategies

Rolling Sharpe Analysis

Track Sharpe Ratios over time to identify periods of underperformance or stress.

Risk-Adjusted Scaling

Adjust position sizes based on rolling Sharpe Ratios, allocating more capital to higher-performing strategies.

Sharpe Ratio vs Other Metrics

- Sortino Ratio: Focuses on downside risk, providing a complementary perspective.

- Treynor Ratio: Measures returns relative to systematic risk (beta).

- Information Ratio: Assesses active return vs benchmark risk.

FAQ

1. Why use Sharpe Ratio for evaluating risks?

Sharpe Ratio provides a quantitative measure of risk-adjusted performance, allowing traders to compare strategies on an equal footing regardless of absolute returns.

2. How to improve Sharpe Ratio in futures trading?

Enhance Sharpe Ratio by:

- Reducing portfolio volatility

- Diversifying across uncorrelated assets

- Using stop-loss and risk management tools to minimize drawdowns

3. Where to apply Sharpe Ratio in trading strategies?

Sharpe Ratio can be applied in:

- Portfolio optimization

- Algorithmic strategy selection

- Performance benchmarking against risk-free rates or alternative strategies

Conclusion

For quant traders, mastering the Sharpe Ratio is indispensable for risk-adjusted decision making. By integrating Sharpe Ratio analysis into portfolio design, algorithmic filters, and ongoing monitoring, traders can maximize returns while controlling risk. Whether through basic calculation methods or advanced optimization techniques, leveraging Sharpe Ratio insights ensures more informed, systematic, and profitable trading outcomes.

Engage and Share: Comment below with your experiences using Sharpe Ratio in live trading, share insights with your peers, and discuss strategies to enhance risk-adjusted performance.