=================================================

In the rapidly evolving world of crypto derivatives, API optimization strategies for perpetual futures are crucial for traders, developers, and institutions looking to maximize efficiency and profitability. APIs (Application Programming Interfaces) are the backbone of algorithmic trading in perpetual contracts, enabling real-time data access, automated order execution, and custom risk management. However, simply connecting to an exchange API is not enough—optimizing how the API is used can be the difference between consistent profits and costly inefficiencies.

This comprehensive guide explores the role of APIs in perpetual futures, compares different optimization methods, shares real-world insights, and provides actionable strategies to enhance performance.

Why API Optimization Matters in Perpetual Futures

Speed and Latency

Perpetual futures trading requires real-time execution, where milliseconds can determine profitability. Optimized API strategies reduce latency, ensuring orders are placed ahead of compe*****s.

Risk Management

Optimized APIs allow for automated stop-losses, funding rate monitoring, and dynamic hedging, minimizing exposure during volatile markets.

Cost Efficiency

Poorly optimized APIs can lead to rate limit errors, redundant requests, and missed trades. Efficient usage reduces overhead and ensures smooth system performance.

Related Insight: Why API is essential for perpetual futures?

Core Principles of API Optimization

Before diving into strategies, it’s important to understand the foundational principles of API optimization:

- Minimize Latency: Deploy trading servers close to exchange data centers.

- Reduce Redundancy: Avoid unnecessary API calls by caching frequently used data.

- Error Handling: Build robust systems that retry failed requests intelligently.

- Rate Limit Awareness: Stay within exchange-imposed API request limits.

- Security: Protect API keys with encryption, IP whitelisting, and multi-factor authentication.

| Category | Details |

|---|---|

| Why API Optimization Matters | Enhances speed, risk management, and cost efficiency for perpetual futures. |

| Speed and Latency | Optimized APIs reduce latency, ensuring faster execution in trading. |

| Risk Management | Allows automated stop-losses, funding rate monitoring, and dynamic hedging. |

| Cost Efficiency | Prevents errors and redundant requests, reducing overhead. |

| Core Principles of Optimization | Minimize latency, reduce redundancy, error handling, rate limit awareness, and security. |

| Strategy 1: WebSocket Integration | Provides real-time data with lower latency and reduced API call volume. |

| Advantages of WebSocket | Instant updates, lower call volume, efficient for high-frequency trading. |

| Drawbacks of WebSocket | Requires stable connection and error recovery management. |

| Strategy 2: REST API Optimization | Involves caching and batch requests for placing orders and retrieving data. |

| Advantages of REST API | Simpler implementation, cache efficiency, batch orders reduce latency. |

| Drawbacks of REST API | Higher latency, limited by strict API rate limits. |

| Comparison of WebSocket & REST | WebSocket is low-latency with fewer limits; REST is simpler but slower. |

| Best Use Cases | WebSocket for real-time data, REST for order placement and portfolio management. |

| Advanced Optimization Techniques | Smart order routing, latency arbitrage, risk-aware automation, ML integration. |

| Smart Order Routing | Routes orders to exchanges with best liquidity and lowest fees. |

| Latency Arbitrage | Deploy bots near exchange servers to reduce latency. |

| Risk-Aware Automation | Automates position adjustment based on market conditions. |

| Machine Learning Integration | Combines APIs with predictive algorithms for better timing and reduced slippage. |

| Security Best Practices | IP whitelisting, encryption, key rotation, and restricting access. |

| Real-World Example | Hybrid strategy reduced latency by 70%, cut redundant calls by 40%. |

| Avoiding Rate Limits | Use request batching, caching, and WebSockets for real-time data. |

| REST or WebSocket for Trading? | WebSockets for real-time, REST for bulk orders. Hybrid approach is ideal. |

| Securing API Keys | Use IP whitelisting, store keys securely, and rotate them regularly. |

| Future Trends | AI-driven APIs, adaptive throttling, and decentralized infrastructures. |

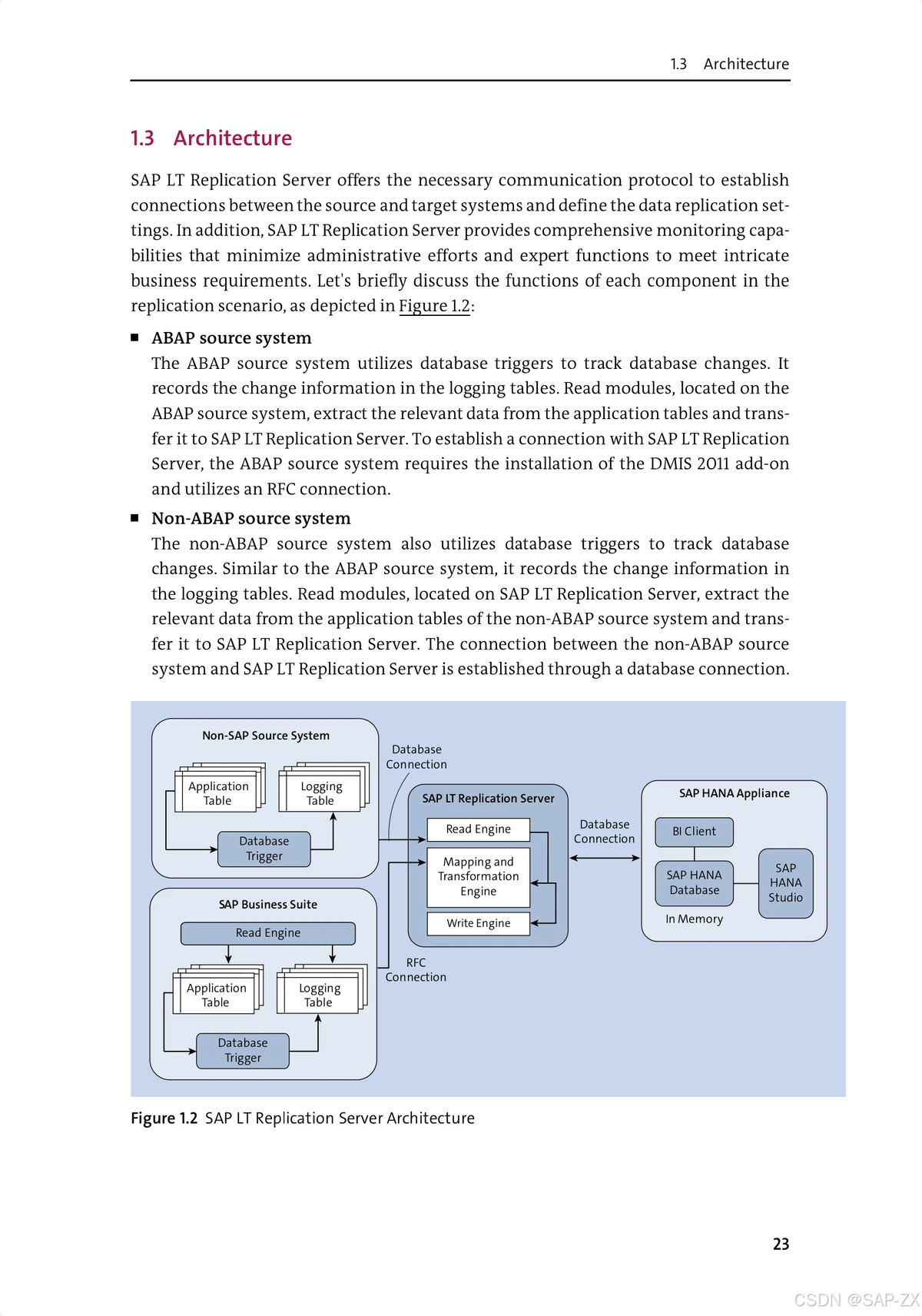

How It Works

Most exchanges provide both REST APIs and WebSocket APIs. REST APIs are ideal for single queries (e.g., account balance), while WebSocket APIs are designed for continuous real-time updates such as order book depth, funding rates, and trade streams.

Advantages

- Instant Updates: WebSocket pushes updates without needing repeated requests.

- Lower API Call Volume: Reduces REST calls and avoids hitting rate limits.

- Efficiency in Scalping: Ideal for strategies requiring microsecond-level updates.

Drawbacks

- Complexity: Requires stable connection management.

- Error Recovery: Must handle disconnections gracefully.

Best Use Case: High-frequency strategies such as scalping, where constant order book monitoring is essential.

Strategy 2: REST API Optimization with Caching and Batch Requests

How It Works

REST APIs remain crucial for placing orders, modifying positions, and retrieving snapshots of account data. Optimizing REST usage involves batching requests and caching data.

Advantages

- Simplicity: Easier to implement compared to WebSockets.

- Cache Efficiency: Store results like exchange info or static trading rules locally.

- Batch Orders: Place multiple orders in one request, reducing latency.

Drawbacks

- Higher Latency: REST cannot match WebSocket’s real-time push updates.

- Rate Limits: Exchanges enforce strict limits on REST calls.

Best Use Case: Medium-frequency traders or portfolio managers who don’t require ultra-low latency execution.

Comparing the Two Strategies

| Factor | WebSocket API | REST API (Optimized) |

|---|---|---|

| Latency | Ultra-low (real-time push) | Higher (request-response) |

| Complexity | Higher (persistent connections) | Lower (stateless calls) |

| API Limits | Fewer restrictions | Subject to strict rate limits |

| Use Cases | Scalping, HFT, funding arbitrage | Portfolio management, periodic rebalancing |

Recommendation: The optimal approach is a hybrid strategy, using WebSocket for real-time data streaming and REST for transactional actions like order placement.

Advanced API Optimization Techniques

1. Smart Order Routing

By integrating APIs from multiple exchanges, traders can dynamically route orders to platforms with the best liquidity and lowest fees.

2. Latency Arbitrage with Co-Location

Deploying trading bots on servers physically close to exchange servers reduces latency. Some professional traders even use colocation services provided by exchanges.

3. Risk-Aware Automation

Through APIs, traders can automatically adjust leverage, hedge positions, or close exposure when volatility spikes.

4. Machine Learning Integration

APIs can be optimized by combining them with predictive algorithms that learn from historical data, improving trade timing and reducing slippage.

Visual Insights into API Optimization

Comparison between REST API and WebSocket API workflows in trading environments

Optimized API architecture for perpetual futures trading combining WebSocket and REST

Security Considerations in API Optimization

Optimizing APIs isn’t just about speed—it’s also about safety. Since perpetual futures trading often involves high leverage, compromised APIs can lead to devastating losses.

Best Practices:

- Use IP whitelisting to restrict access.

- Store API keys in encrypted vaults.

- Assign read-only keys for data feeds and trade-only keys for execution.

- Rotate API keys periodically.

Related Insight: How to secure API for perpetual futures trading?

Real-World Example: API Optimization in Perpetual Futures

A proprietary trading firm implemented a hybrid WebSocket + REST strategy with co-location services. By caching static REST data and using WebSockets for live feeds, they:

- Reduced latency by 70%,

- Decreased redundant API calls by 40%,

- Improved trade execution success rate by 25%.

This demonstrates how small improvements in API optimization can lead to significant competitive advantages in perpetual futures markets.

FAQ: API Optimization in Perpetual Futures

1. How can I avoid hitting exchange API rate limits?

Implement request batching and caching for static data. Use WebSockets for continuous updates instead of repeatedly polling REST APIs.

2. Should I use REST or WebSocket for perpetual futures trading?

For real-time strategies like scalping or arbitrage, WebSockets are superior. For account management and bulk order placement, REST remains essential. A hybrid approach offers the best balance.

3. How can I secure my perpetual futures trading API keys?

Enable IP whitelisting, store keys in encrypted vaults, avoid sharing keys across multiple bots, and rotate them frequently to prevent unauthorized access.

Conclusion: The Future of API Optimization in Perpetual Futures

The perpetual futures market is becoming increasingly competitive, and API optimization strategies are the key differentiator for both retail and institutional traders. By leveraging WebSocket APIs for real-time data, REST APIs for efficient order execution, and adopting best practices in caching, security, and risk management, traders can significantly enhance their performance.

As exchanges continue to innovate, we may see AI-driven APIs, adaptive throttling, and decentralized API infrastructures becoming standard. For traders, now is the time to master API optimization and build systems that scale with market demands.

👉 Did you find these API optimization strategies useful? Share this article with fellow traders, comment with your experiences, and let’s discuss how API-driven trading can transform perpetual futures markets!