==========================================

As trading volume grows and strategies become more sophisticated, fee tier resources for experienced traders play a crucial role in maximizing profitability. Even a minor reduction in fees can significantly impact long-term returns, especially in high-frequency trading environments like perpetual futures. In this article, we’ll explore how advanced traders can leverage fee tiers effectively, compare different strategies, and highlight the best resources to optimize costs without sacrificing execution quality.

Understanding Fee Tiers in Trading

What Are Fee Tiers?

Fee tiers are structured pricing systems set by exchanges or brokers that reward higher trading volumes with reduced transaction costs. They typically include maker fees (for adding liquidity) and taker fees (for removing liquidity).

Why Fee Tiers Matter for Experienced Traders

- Direct impact on profitability: A 0.02% fee difference can drastically reduce costs in leveraged trades.

- Competitive advantage: Lower fees allow tighter spreads and more aggressive strategies.

- Scalability: As volumes increase, optimized fee tiers provide exponential cost savings.

Example of a tiered fee structure

Understanding how fee tier affects perpetual futures profitability is the foundation for building sustainable trading systems.

Fee Tier Structures Across Markets

Spot Markets

Exchanges usually offer fee reductions based on monthly trade volume or token holdings. Experienced traders often qualify for the lowest tiers.

Derivatives Markets (Perpetual Futures)

Here, fees are more complex due to leverage. Traders must consider funding rates, execution costs, and liquidation fees alongside tier structures.

Institutional Platforms

Institutions benefit from customized fee agreements with brokers, often bypassing standard tier systems entirely.

Strategies to Optimize Fee Tiers

Strategy 1: Volume Consolidation

Instead of splitting volume across multiple platforms, traders can focus activity on a single exchange to qualify for higher-tier discounts.

Pros:

- Quick path to top-tier fee reductions.

- Simplifies accounting and portfolio tracking.

Cons:

- Limits diversification across platforms.

- Increases dependency on exchange stability.

Strategy 2: Maker-Taker Optimization

Experienced traders design strategies to maximize maker orders, which often have lower fees (or even rebates).

Pros:

- Reduces effective trading costs.

- Encourages liquidity provision strategies.

Cons:

- Execution can be slower.

- Higher risk of unfilled orders in fast-moving markets.

Strategy 3: Leveraging Fee Discounts and Tokens

Some exchanges offer additional discounts for paying fees in native tokens (e.g., BNB, FTT).

Pros:

- Significant percentage discounts.

- Flexibility for traders holding platform tokens.

Cons:

- Exposure to token price volatility.

- May not be available on all platforms.

Comparing Fee Tier Optimization Strategies

| Strategy | Best For | Risk Level | Key Limitation |

|---|---|---|---|

| Volume Consolidation | High-volume professionals | Moderate | Lack of platform diversification |

| Maker-Taker Optimization | Algorithmic & HFT traders | High | Execution delays |

| Fee Discounts with Native Tokens | Token-savvy, long-term traders | Low | Token volatility risk |

Based on personal experience, combining volume consolidation with selective maker-taker strategies provides the best balance for advanced traders. Token-based discounts are best treated as supplementary.

Where to Find and Compare Fee Tiers

Finding reliable information is essential. Traders often explore:

- Exchange websites: Direct resources for tier structures.

- Community-driven dashboards: Aggregated fee comparisons across platforms.

- Broker-provided materials: Tailored insights for institutional clients.

For example, knowing where to compare fee tier in different perpetual futures platforms helps traders avoid hidden costs and select the most cost-efficient venues.

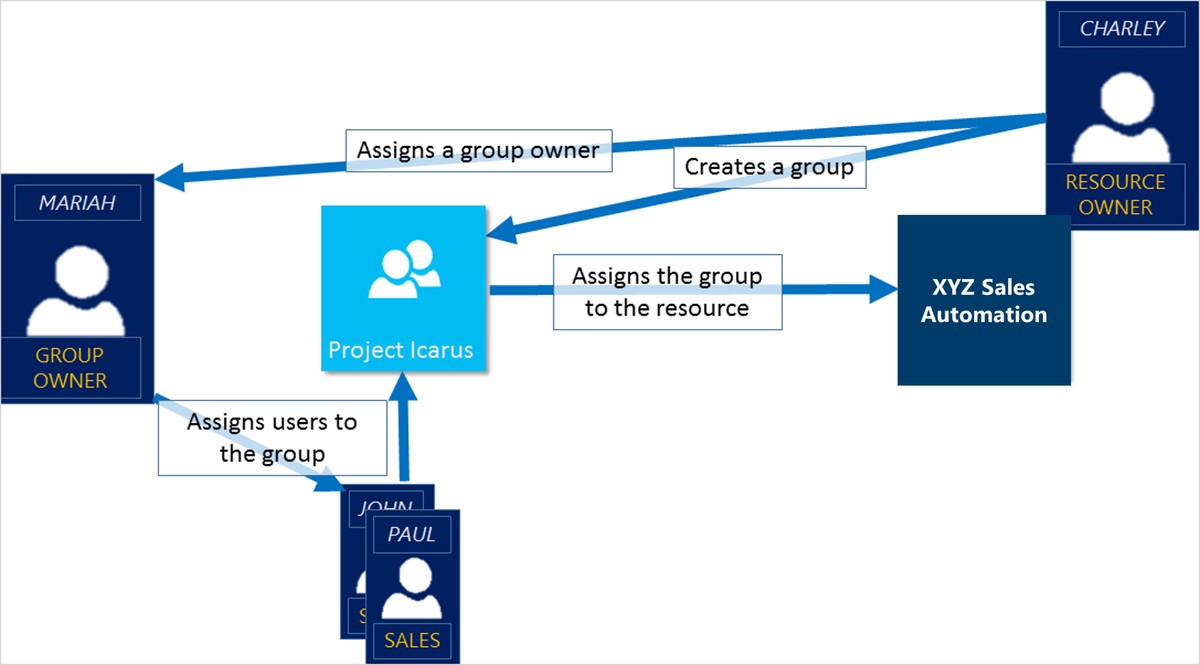

Comparing exchange fee tiers for perpetual futures trading

Advanced Fee Tier Tools

Interactive Calculators

These tools estimate fee savings across different volume levels and trading styles.

API Integration

Algorithmic traders can pull fee tier data directly into their systems for real-time strategy optimization.

AI-Based Analysis

Emerging tools use AI to recommend the best exchanges and fee tiers based on historical trading data and projected activity.

Personal Experience: How I Optimized Fee Tiers

Over the years, I’ve tested multiple approaches:

- Initially split trades across 4 platforms, losing higher-tier benefits.

- Consolidated activity to 2 platforms, unlocking top-tier discounts.

- Implemented maker-first strategies, cutting effective costs by 25%.

This practical experience highlights the importance of how to calculate fee tier in perpetual futures and plan trades accordingly.

Emerging Trends in Fee Tier Systems

- Custom Negotiations: Exchanges increasingly offer bespoke fee deals for frequent traders.

- Gamification of Fee Tiers: Platforms use loyalty programs to encourage volume growth.

- Cross-Market Benefits: Some brokers extend fee discounts across spot, futures, and options.

These trends are reshaping how advanced trader fee tier strategies are implemented in practice.

AI-powered dashboard for optimizing fee tier strategies

Common Mistakes Experienced Traders Make

- Ignoring Hidden Fees

Not accounting for funding rates or withdrawal fees reduces the effectiveness of fee tier discounts.

- Chasing Discounts Blindly

Over-trading to hit a higher tier often increases risk unnecessarily.

- Neglecting Execution Quality

Lower fees mean little if slippage and latency erode profitability.

FAQs on Fee Tier Resources for Experienced Traders

1. How can I evaluate if my current fee tier is optimal?

Track your effective cost per trade, including hidden fees and slippage. Use fee calculators to compare potential savings with higher tiers.

2. Is it better to focus on fee tiers or execution speed?

For high-frequency traders, execution speed often outweighs fee discounts. For swing or long-term traders, optimized fee tiers can have a bigger impact on net returns.

3. Are fee tier discounts sustainable in the long term?

Yes, but exchanges may adjust policies. Keeping up with fee tier policy updates review ensures traders adapt quickly to structural changes.

Conclusion

For experienced traders, fee tiers are not just a cost consideration—they are a strategic resource that directly impacts profitability and competitiveness. By mastering strategies like volume consolidation, maker-taker optimization, and token-based discounts, professionals can reduce costs while scaling efficiently.

As exchanges innovate, traders who actively monitor and adapt their fee structures will continue to gain an edge in perpetual futures and beyond.

📢 If this guide gave you insights into fee tier resources for experienced traders, share it with your trading peers, drop a comment about your fee optimization strategies, and help build a smarter trading community.